ADVANCED ON PURPOSEAn educational blog with purposeful content. We welcome open and polite dialogue, and expect any comments you leave to be respectful. Thanks! Archives

May 2023

Categories

All

|

Back to Blog

Mer on the Mic5/7/2023 2 MIN READ I’m grateful to nonprofit organization LEAD Filipino for having a local open mic night that I could write for. Bahay! Home of the Kreatives is a community-made environment where local FilAm, AAPI, BIPOC, Queer, and Trans creatives are invited to shape what an unapologetic, safe, healing, and sharing space looks and feels like in the heart of the ever-changing San José. I encourage you to sign up for a future open mic as an audience member, vendor, or performer! On May 6th I joined LEAD Filipino at My Gypsy Soul for my first open mic performance in ages. There I read two pieces that I wrote in January 2023: “Turning 40” and “2023.” You can read both pieces below. Turning 40This year, I turned a few new pages Remembered that my body ages Remembered that the things it chases Have been things that lead to disgraces. This year, I upgraded my book Celebrated the risks I took Celebrated the folks I shook Caused good trouble, made them all look. This year, I shed unwanted fears Oiled up my chains, tightened my gears Oiled up my skin, braced for the sneers Pushed back hard for my family’s cheers. This year, I learned how untangled I Can become that which they decry Can become that which they deny Should have the power seen in my eyes. This year I turned 40, all the wiser More of a watcher, more of a fighter More of a speaker, more of a writer Unleashing all that hides inside her. This year, and the next year, watch out now I am no longer scared of how I am no longer backing down Untangled from them, watch them bow. 2023Tainted Coming out of 2020 Painted Red with tears in 2021 Waited For better days in 2022 Today Wondering if the pain and fear are done. Wondering Is 2023 the year that I Stop fearing if I’ll die Before I say my goodbyes Blundering About with fear still in my eyes Tired of all their lies Staring up at the skies Thinking that this year it just might be Bringing the positive energy that I need Blinking away all of the nightmares that feed The shrinking that’s happening inside of me. But maybe it’s because I’m wound and I’m riled up I’m bound and defiled up Straight dripping with stardust While knowing that I must Unleash what I’ve hidden Goodbye and good riddance To dusty old sleaze men Who think i’ve become them Lord no, it’s not within Me to forget herstory Sweet like cat purrs to me Unconscious but can see You kill my community Destroyed what was true in me Distilled what was good in me Til all that you could see Is what you now rue in me Dripping gold like a queen Shining bright, dynasty You cannot murder me Not in 2023.

0 Comments

Read More

Back to Blog

6 MIN READ

Why host a Galentine's Day Dinner? Ever watch the show "Parks and Recreation?" One of my favorite characters is Leslie Knope, who hosts an annual Galentine's Day dinner for her coworkers and friends. In early 2023, I felt like I was still trying to get back to a sense of ease and safety when it came to networking. I struggled in 2022 to travel and go to large group events again. I was exhausted trying to relearn how to be an extrovert, and after talking to womxn who I love and admire, I knew I was not alone in this. Thus, I was inspired to encourage my sisters to join me in coming out of our pandemic-formed shells. My personal mission is to build the capacity of people who build the capacity of others. I also endeavor to cultivate safe spaces and help others do the same. The lightheartedness of celebrating other womxn in your life, on a day that is traditionally focused on romantic rather than platonic love, felt like what I needed. So I figured, other women must need this too, and I was right. The response from both those who could and could not make our dinner was overwhelmingly positive. The goal of this blog is to inspire other womxn to host their own Galentine's Day events in their cities and counties. Note that the toolkit and templates provided can be adapted for any event theme or holiday. Planning My First Galentine’s Day EventI volunteered to project manage this event and recommended San Jose to be the focal spot for the first Galentine’s Day. I also suggested that the first event be intimate at 20 people or less, so that we could reserve a small room or a few tables at a San Jose establishment. Last, we provided a menu of light activities for folks to do together so that the event was not too structured but did offer ways for folks to engage (e.g. trivia, game, white elephant gift, peer share prompts).

AdvancED Tip: Once you have your first event under your belt, and your own adapted toolkit for your local nuances, you can plan this event easily, annually, offering a beautiful space for connection and affirmation for the womxn in your community. The Timeline for the 2023 Galentine’s Day The following is what it looked like to plan my first Galentine’s Day event, from start to finish. The event was planned and executed in 30 days by 3 hosts.

A Toolkit with Templates to host future Galentine’s Days One of my favorite artifacts after an event or project is a “toolkit.” For me, a toolkit includes answers to the 5 Ws and H:

You can access my resources here:

Have ideas for future Galentine’s Day events or feedback on our toolkit and templates? I look forward to your thoughts! Please post a comment.

Back to Blog

Big Dog Vineyard Wedding | Curry + Nuñez11/25/2022 Article by Marissa Martinez & Meredith Curry Nuñez 7 MIN READ The wedding of Meredith "Mer" Curry and Michael Nuñez began not the morning of Sunday, April 24, 2022, and not even a month prior when they had to last minute confirm a vineyard as the venue, not 2 years earlier when Mer proposed to Michael -- it all started 8 years earlier when Mer and Michael were set up on a blind date. Mer is currently the Executive Director of the Northern California College Promise Coalition (NCCPC) and is the founder of AdvancED Consulting, LLC. Michael works as a consultant working with local firms like AdvancED Consulting after previously owning and operating several health clinics around Silicon Valley. They are both dedicated to supporting college access and career development for Black Indigenous People of Color (BIPOC) students, young adults, and entrepreneurs in the local community and across CA. No wonder close family brought them together back in 2014! It started with a blind date at San Pedro Market in downtown San Jose, a place they both loved to frequent long before they met. That first date quickly blossomed as they toured the City of San Jose together, fell in love with its local parks, and even managed local and national events as consulting event coordinators. How fitting that 8 years later they would work together to coordinate the biggest event of all -- their own wedding! Credits: Miguel Ozuna Photography Engagement photos, Alum Rock Park in East San Jose, CA Fast forward to Spring 2022 and the happy couple was ready to exchange their vows in a San Jose park, looking forward to starting their new chapter in the heart of their city. Not unlike any wedding, theirs had a hiccup or two -- but when they found out that the park could no longer meet the needs of their big day, 42 days before their scheduled wedding, they had to pivot fast.

The wedding ceremony was hosted on the front lawn, overlooking the beautiful Silicon Valley. It was picture-Esque watching the wedding party walk down the aisle and see the bride and groom share their love in front of the majestic tree. Credit: Miguel Ozuna Photography Throughout the ceremony, evening, and reception the theme of the night was not only Mer & Michael’s love for each other but also the love they have for their family and friends and the love their community has for them. They had their own logo which appeared on the invitations, wedding website, printed programs, and even coasters, thanks to Angel Trazo. The ceremony was officiated by Michael’s best man, cousin, and prior business partner JT White. The talented styles of Astralogik, a Queer Pinay Duo from the Bay Area, played all night with hits from the oldies to the 90s, including serenading Mer with “At Last” by Etta James as she walked down the aisle.

Credit: Miguel Ozuna Photography (Left) Astralogik | (Right) Porras Solutions The wedding party’s boutonnieres and bouquets were all lovingly hand-made by Michael with help from his family and friends. The opening prayer was led by Adelina Tancioco, a friend of Mer’s who partnered with her in June 2020 to host a 7-day virtual Pop Up Healing Center. Roderick Bersamina, a long-time friend of Mer's, recited spoken word poetry written just for the occasion. Credit: Miguel Ozuna Photography Succulent bouquets by Michael Nuñez After the couple said “I do,” guests were ushered to the back patio for the cocktail hour. The lumpia and empanadas were tasty and the sangria and wine were flowing. It was the perfect start to the evening as the emcee Susan Ramsey, host of The Sansu Show and long-time family friend of the Currys, introduced the wedding party and the married couple. The reception was hosted back on the front lawn just as the sun was setting. The handmade, local vibes continued as the dinner tables and gathering spaces were decorated with the wedding favors: succulent arrangements by Michael and his mother Rose, mini canvas paintings by Michael’s dad Ray and his uncle Richard, and lemon-scented custom candles by Michael’s aunt Ramona Cresci. Mer’s friends Alerie Flandez and Amparo Diaz graced the event with their own creative stylings, from Alerie’s gorgeous gift card box to Amparo’s crocheted ring pillow and flower child baskets. You could tell just by looking all around you from the tables to the decorations that everything was thoughtfully created. Thanks to Miguel Ozuna Photography, every beautiful moment from the rehearsal dinner to the wedding day was captured. Credit: Miguel Ozuna Photography Centerpieces by Michael Nuñez, Rose & Ray Nuñez, and Ramona Cresci Credit: Miguel Ozuna Photography (Bottom left) Ring pillow by Apple's Handmade Creations The entire day (and the weekend) was a literal labor of love. As a couple rooted in their passion for nature and commitment to serving their community, the local vineyard with the attention to detail by so many local caterers of color was the perfect setting for the first day of Mer & Michael’s next chapter. Mer & Michael send all of their love and gratitude to the family, friends, vendors, and community that made their wedding day, and their relationship, so special and unique. Credit: Miguel Ozuna Photography Memorable Moments from Mer & Michael

Credit: Miguel Ozuna Photography Mer & Michael’s Inspirations Michael has had a green thumb (more like his whole body!) since he was a young child. Throughout his life, he has had a passion and unique talent for growing succulents and crafting beautiful arrangements. That’s why everything from the bridal party flowers, to the table centerpieces, to the cupcakes, to Mer & Michael’s signature logo was adorned with succulents. The blending of various succulents and cacti mimic the blending of Mer & Michael’s families, both mixed: Mer a Black and Filipina, and Michael with Mexican, Native American, El Salvadorian, and Sicilian roots. Mer loves to plan events. And she loves to plan events with local small businesses that are women-, immigrant-, and/or BIPOC-owned. She was grateful to work with local vendors to design a wedding that was more beautiful than her wildest imagination, thanks to coordinators Beth Norber of BN Events and Victoria Hurly. She believes that when you take a breath, set an intention, and take a step back to let things fall into place as they will, as they certainly did in the 42 days it took to plan the wedding, it’s a sign that the universe is at work to manifest those intentions. Mer also believes that she was able to react with calm and composure to the drastic changes in her wedding plans because of her years-long meditation practice, which you can learn more about in her blog article One Thousand Days of Calm. Credit: Miguel Ozuna Photography Our Tips (from Mer & Michael)

Coordinator Pre-Wedding: BN Events | Coordinator Wedding Weekend: Victoria Hurly | Venue: Big Dog Vineyards | Makeup Artist: Roan Make-Up | Desserts: K’s Desserts | Catering: Porras Solutions | Music: Astralogik | Photography: Miguel Ozuna Photography | Rehearsal Dinner: Mama Mia’s Restaurant | Wedding Logo: Angel Trazo Credit: Miguel Ozuna Photography Credit: Logo by Angel Trazo

Back to Blog

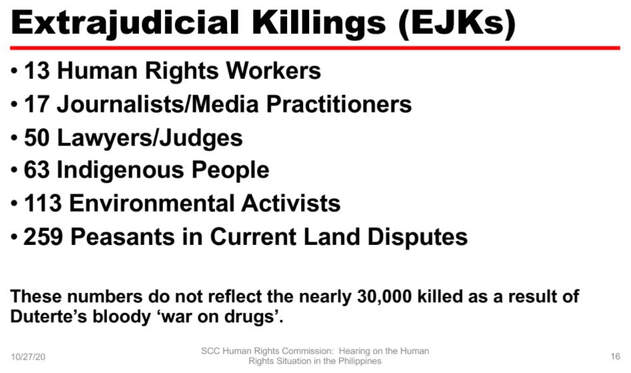

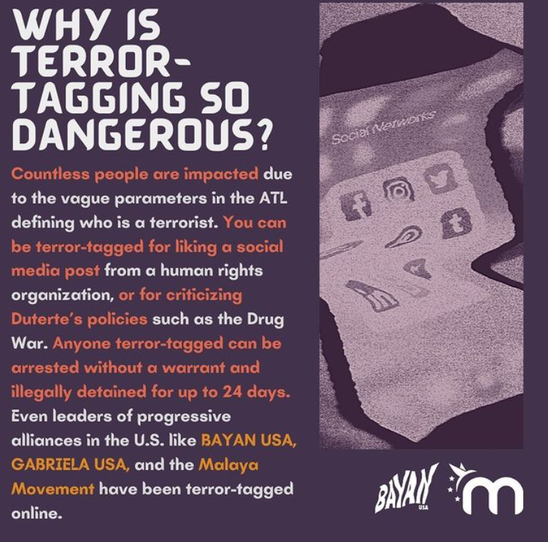

4 MIN READ We are not separate from each other. If we take a simple product, such as a scented candle - note that the wax, wick, and essential oils are manufactured in different parts of the world; the global political economy connects us all. In the community organizing circles I’ve been a part of in San Jose, CA the fantasy vision is an international working class revolution. Similarly to the candle, creating wide-spread change cannot happen without intention, hard work, and of course, time. One cannot decide who or what comprises a community, but it takes strategy, commitment, and honestly, all of us working together to protect the most vulnerable. A splendid example is the work being done by Filipino organizers in Santa Clara County on the Philippine Human Rights Act (PHRA). In September 2020, Susan Wild (D-PA-7) introduced The Philippine Human Rights Act (H.R. 8313) to the United States House of Representatives. In essence, the act suspends U.S. military aid to the Philippines until the Philippine Government addresses and responds to the human rights violations. The original cosponsors of the bill are local Santa Clara County representatives, congressional representative Ro Khanna (D-CA-17) and congressional representative Zoe Lofgren (D-CA-19). Over 90,000 Filipinos are living in Santa Clara County, many of them with families and friends still living in the Philippines. Recently, Santa Clara County’s Human Rights Commission (HRC) hosted a public hearing on whether or not to pass a resolution supporting the PHRA. On October 27, a warm pandemic Tuesday evening, Santa Clara County’s HRC voted unanimously in passing a resolution to support the PHRA; California State Assembly members Ash Kalra (CA-27) and Rob Bonta (CA-18) announced their support of the resolution and the PHRA. Community organizers from LEAD Filipino, Mayla Movement South Bay, and Kabataan Alliance initially approached Santa Clara County Board President, Supervisor Cindy Chavez to ask for her support of the PHRA. The collective worked with Dr. Justin Boren, the chair of Santa Clara County’s HRC for its next steps in writing and presenting a resolution to the commission for consideration. The pieces needed for the resolution to be written, PHRA created, and relationships mobilized is rooted in years of intention and work by activists in the United States and internationally. Most activists understand on one level or another, they are putting their bodies and lives on the line each time they take action in building momentum against an established government regime, even overseas. President Duterte’s Anti-Terrorism Act of 2020 allows for the Duterte’s Administration’s Anti-Terror Council to designate individuals as terrorists and publish their names on government websites and newspapers. Under The ATL’s implementing rules and regulations, there is an inclusion on extraterritorial application that has led to a practice called “terror tagging” or “red tagging”. Shortly after the Santa Clara HRC’s public hearing, panelist and expert witness Adrian Bonifacio, chairperson of Anakbayan-USA, was terror tagged by the Facebook Page, “For the Global Public” (listen more in an interview at PFA 94.1 at 43:45 here). Anyone attempting to publicly criticize the Duterte Administration is labeled a communist terrorist and subject to defamation and targeting by the Philippine Government. As a Black and Filipina woman, Meredith Curry, owner of AdvancED Consulting has concerns that this article, written in partnership and in friendship with myself, will put unwanted attention on us and our loved ones. Because you don’t actually have to be Filipino to be in danger, as proven by countless victims including Brandon Lee, a Bay Area native who was critically injured after an attempted assassination in 2016. Duterte’s regime has targeted more well-known Filipinos as well, such as the red-tagging of Miss Universe 2018, Catriona Gray, and Santa Clara-born actress, Liza Soberano. If you read the linked article, you’ll see that threats of violence were made towards women who were taking part in an online discussion advocating for the rights of women and girls. General Parlade stated to Liza Soberano, a participant in the online discussion, “There’s still a chance to abdicate that group” otherwise she would “suffer the same fate” as Josephine Ann Lapira, a young activist killed in a 2017 battle between the military and the Communist Rebels, The New People’s Army (Oct 2020). According to Malaya Arevalo, the National Secretariat of the Malaya Movement and expert witness at the Santa Clara HRC public hearing, 13 human rights workers, 17 journalists, 50 lawyers and judges, 113 environmental activists, and 259 farmers have been killed since Duterte took office - without counting the 30,000 casualties with Duterte’s war on drugs. During the Santa Clara County HRC public hearing, a member of the committee asked how the PHRA would affect the lives of Filipino-Americans. There were several answers to this, one being that it would be safer for undocumented Filipinos to seek help without fear of being deported. Another would be freedom of speech, a right protected in America and yet unavailable to its brothers and sisters living in another country. America has long touted its reasons for military presence and occupation of other countries as defending democracy and freedom, but we won’t get into that here. The point is, the PHRA is in alignment with the American values of freedom, liberty, and justice, without needing to use its military force. The United States is a powerful country, not only because of their military resources but also because of its wealth and influence; it would be unpatriotic to witness the suffering of other Americans, their friends and family, without stepping in and supporting a non-violent response to stop a violent situation. The red tagging/terror tagging of other Americans without a response of support from the United States is a precedence we do not want to set. The Philippine sovereignty needs to be accountable to its people, especially if it is an ally of the United States as a defender of freedom; we should work together to make the world better for citizens living in both countries. The letter Susan Wild (D-PA-7) used to gather support for the PHRA from her peers succinctly gives information about the PHRA and how it will work, as well as previous legislative efforts made by Barbara Boxer, a previous California Senator. Effective community organizing involves everyone in the community. The diasporic Filipinx community has included in its organizing, all levels of government in the United States in conjunction with the national and international efforts of International Coalition for Human Rights in the Philippines (ICHRP), GABRIELA, LEAD Filipino, Mayla Movement, Kabataan Alliance, amongst the many others involved. Much of the movement is fueled by the passion of student activists and young people who care deeply about families, communities, and true freedom. I identify as Vietnamese American and look to these folks as an example of unity and resilience as they continue to fight for their people despite the barriers and dangers of organizing against the Duterte Regime. If you would like to do more to support the PHRA:

Back to Blog

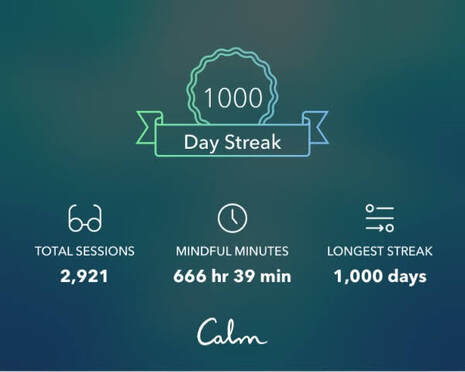

One Thousand Days of Calm8/31/2020 5 MIN READ I have so far invested over three years to my practice and it has been the best investment of my life. I've met the most extraordinary professionals who have practiced 5+ years, 10+ years, and 20+ years, all very much human, all very much benefiting in their own ways from their own unique practices. I didn't just try mindfulness meditation, or any kind of meditation. My best friend Lara recommended the mobile app Calm to me during a stressful time of my life, and for me it's made all the difference. I know friends and colleagues who've tried all kinds of different meditation apps, websites, YouTube channels, etc. This article will highlight the resources I or my trusted allies have used and vetted, so that you can choose for yourself what is right for you. Whenever possible I like to try all the different options, because from day to day I never know what will speak to me, so I keep my mind and heart open. There are options for you that are free or require monthly or annual subscriptions. I am not being paid to push any of these products, I just get a lot of questions about what I use or what I know is useful, so this is where I document my findings. I hope you find something here that speaks to you, but if not, it doesn't hurt to give something new a try! 1,000 days of mindfulness meditationYesterday (Sunday, August 30, 2020), I hit 1,000 days of daily meditation practice, using the mobile app Calm! This is just one of what I hope to be many huge milestones for me as I pursue personal well-being, clarity, fulfillment, and most importantly, appreciation for my life as it is, in this moment. I've had the Calm app since December 14, 2016. At this point in the game, I have to admit I am a champion of Calm. Whether or not I'm a formal affiliate (in the works), I am definitely an admirer and evangelist. Not just because it's a great app whether you use the free version or the subscription version, but because they also facilitate a fantastic Facebook community and YouTube channel, all for free-zies! They help millions! In this review, I'll explain what I used, why I used it, and how I think it helped me in real life. So what has it done for me? Mindfulness meditation is now the undercurrent to every waking, conscious moment. It manifests itself in the following ways and this isn't a comprehensive list:

Whether you are just starting out with meditation or have been doing it for awhile, continue your practice! It can only bring greater peace to your life, no matter how much time you can dedicate to it. You are making an investment in YOU. No one else can do that for you.

Music and Meditations Music for all times of the day Music isn't for everyone, but it is 100% for me. I've been singing, dancing, and listening to music since the womb. I love using Calm's instrumental music as background noise while I work, shower, meditate, stretch, and more. Check out this 30-minute Relax piece on YouTube. Meditations for what ails ya' What I appreciate most about Calm is the thoughtfulness and intentionality in the narrator, Tamara, and her messages.The writing really speaks to you and is relatable, no matter what you're going through in life. For just a taste, check out this Mindfulness Meditation on Santosha (11:16) on YouTube. Are there other apps out there to consider? Of course there are! One of them is InsightTimer. This I use when I'm not using Calm.

Are you a gifted meditation teacher? InsightTimer is looking for you! "Make a difference. Add an income." Become a teacher! Enjoy Affirmations from Calm

Back to Blog

5 MIN READ This article picks up after the 4th article in a series on "Financial Aid, College Choice, and COVID-19" In the last article in the series, Financial Aid, College Choice, and COVID-19, I spoke about the importance of supporting our students and families as they navigate the next steps in their college journeys by making sense of their financial aid options. In Supporting Students & Families through the Conundrum, I encourage college-bound students to “consider the power of savings and learn how to budget. You can make it work if you know what’s in front of you and take the time to thoughtfully plan it out.” This guidance should be given to students much earlier in this process, way before they apply to college. Comprehensive college access programs that work with first-generation and pell-eligible students often have a component in their curriculum that focuses on financial aid. Among the learning outcomes of such lessons, students will hear about budgeting and learn terms like “interest” and “credit” so that they can effectively manage their financial aid awards, like loans. In The Financial Aid Conundrum, I encourage us to take a step back and ask ourselves, “are our students truly equipped to tackle conversations and decisions around financial aid?” Because if the answer is no, then the next question should be, “what are we doing, or not doing, to help students understand basic financial concepts and empower them to make informed choices on their own?” As we learn from Treasury.gov, the financial literacy of our students in high school is lower than most countries. Furthermore, socio-economically disadvantaged students score lower in financial literacy, the equivalent of three school years.

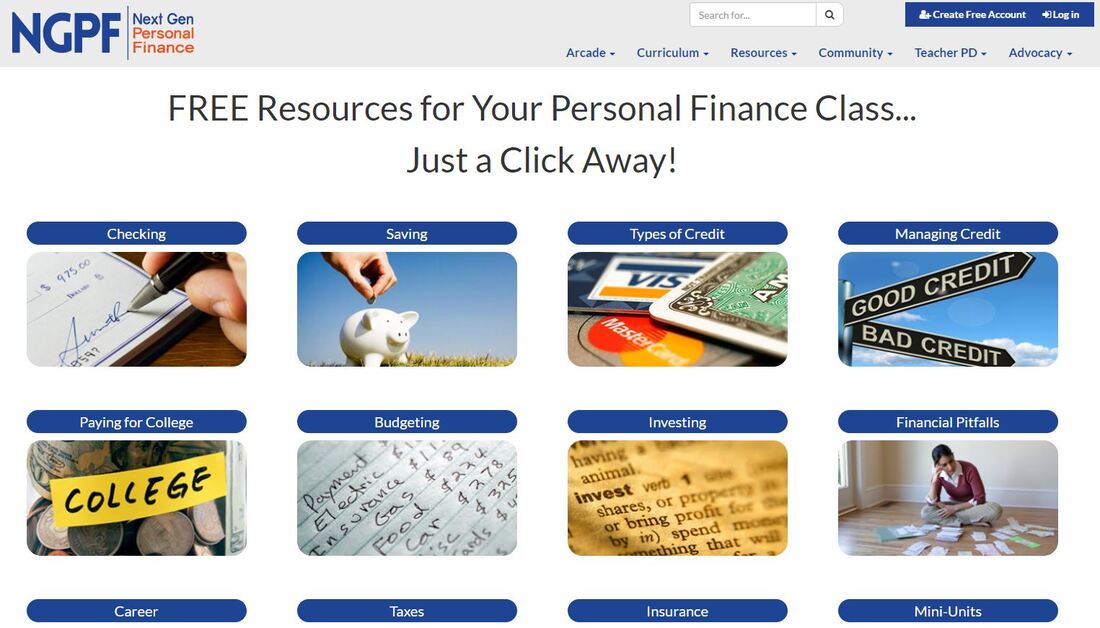

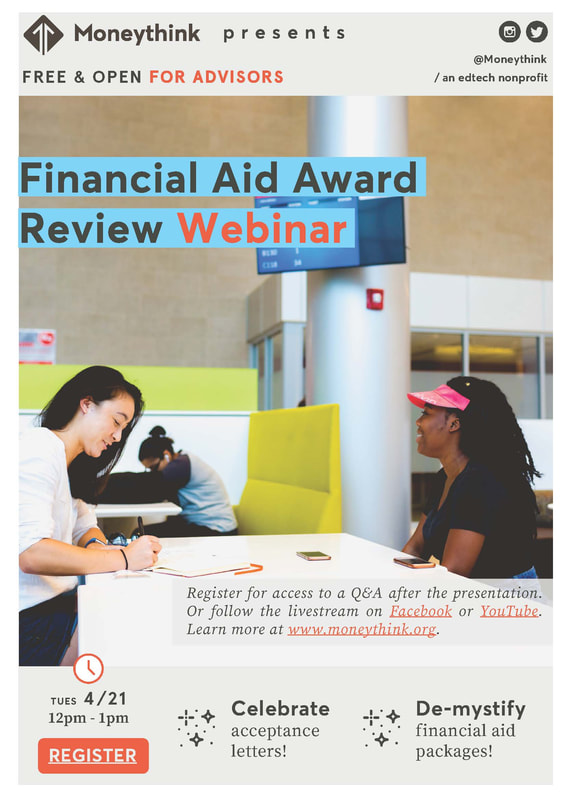

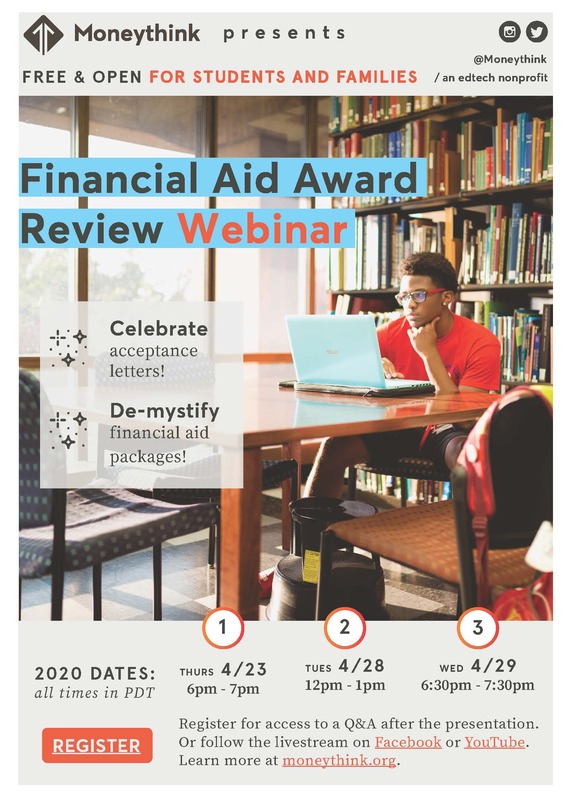

Here’s my attempt at making the relationships clearer: How early should students build their financial literacy to prepare for college? ASAP, early, and often! I agree with Next Gen Personal Finance (NGPF) who decided in 2014 that it was critical to provide teachers with access to “timely and relevant curricular resources, providing effective professional development, and advocating to increase access to financial education.” NGPF’s mission is to revolutionize the teaching of personal finance in all schools in order to improve the financial lives of the next generation of Americans. As of 2019, NGPF's curriculum and professional development extends to 25,000 middle and high school teachers reaching more than 2 million students. This grassroots movement of personal finance educators has committed to Mission: 2030. That is, by 2030, ALL students will take a one semester personal finance course before graduating from high school. Personally and professionally, I think we can and should do even more than one semester of a personal finance course during students’ secondary education. It should start as early as elementary school, have scaffolding throughout middle school, and be grounded in real-life decisions during high school. NGPF has a suite of curriculum broken into various units such as Types of Credit, Managing Credit, Paying for College, Budgeting, and Financial Pitfalls. Even when students are armed with the basic financial concepts they need to tackle financial aid, they will still need support. This is why I’ve worked with Moneythink since 2019 to support first-generation, pell-eligible students in navigating the financial aid process. Moneythink empowers students to invest in the future by building technology that clarifies college finances. In collaboration with the star-studded team at Moneythink, we hosted financial aid webinars in late April to support graduating high school seniors across the country. Check out the recording! Moneythink is gearing up to release their new public-facing tool, DecidED, this fall! DecidED completely removes the guesswork out of college affordability for students and their families, as well as enables counselors and advisors in the space to have productive conversations with their students about the tradeoffs of college options. DecidED helps students and their families:

Check out how Moneythink is working to support students and advisors through COVID-19 and beyond. Follow and subscribe to Moneythink's email list to stay up to date. “Together, we can help our students not just survive but thrive. Not just complete, but succeed. Our students can achieve #lessdebtmoredegrees while we design a pathway towards an economically sustainable future for themselves and their families.” Want to learn more about financial literacy and financial aid issues?

Here are a few resources to help you build your knowledge and comfort-level with discussing these issues with colleagues, students, and families.

Back to Blog

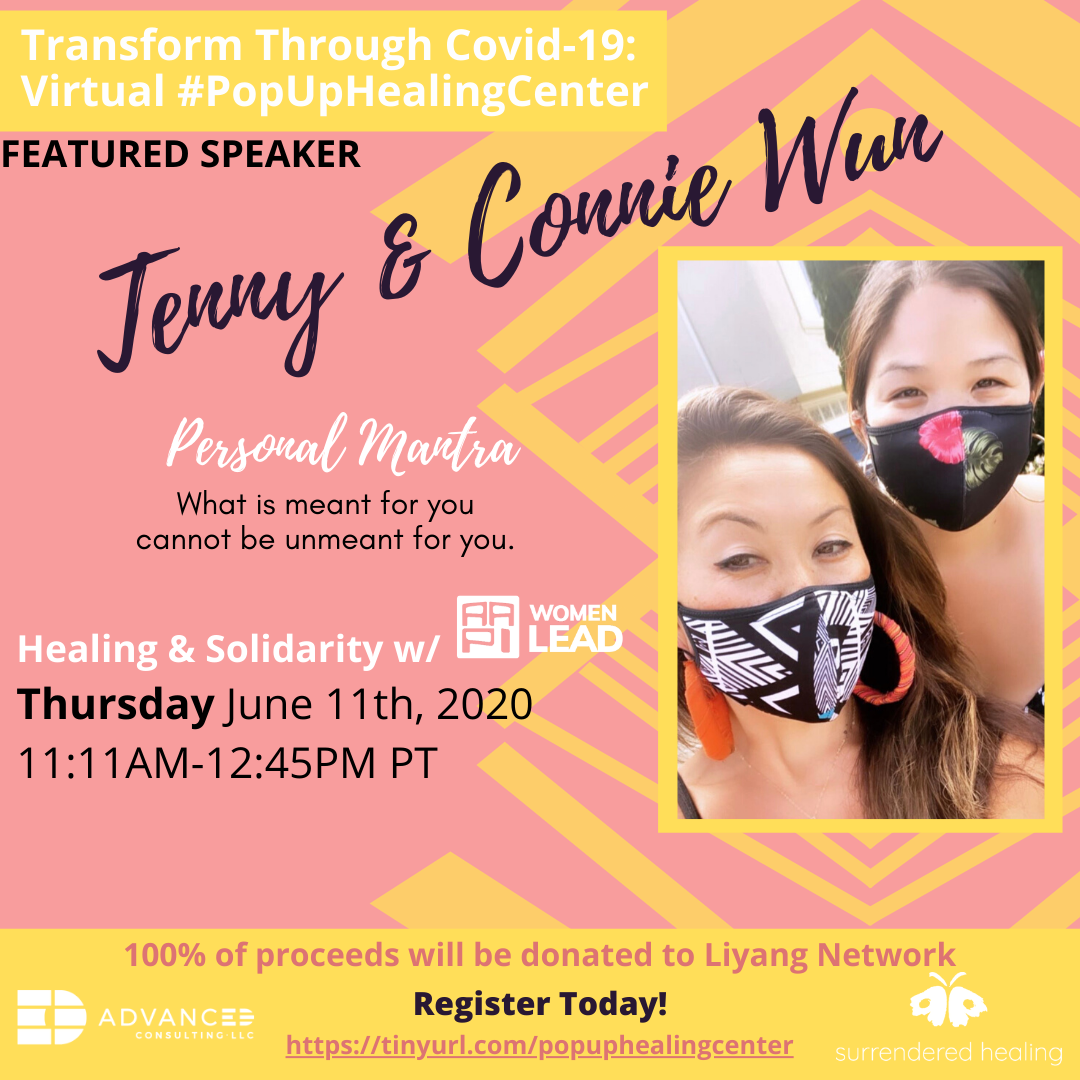

Heal at 11:11, Heal for Life5/27/2020 3 MIN READ FOR IMMEDIATE RELEASE CONTACT: Meredith Curry, Owner & Principal Consultant of AdvancED Consulting, LLC mer @ advancedconsulting.org Over 20 Healers of Color From Across the Country Deliver Free Healing When It’s Needed Most Heal in Solidarity: Starting on Saturday, June 6, 2020, AdvancED Consulting, LLC and Surrendered Healing, solo entrepreneur women of color from the Bay Area, will offer a Virtual #PopUpHealingCenter for free for seven afternoons straight. What do we mean by healing? Well, does your heart hurt? Or your head? Does your bank hurt? Do any relationships hurt? Then you can use some healing! And this event has over 20 people ready to support your healing through movement, creativity, and mental enhancement. "11 is a 'master number' which signifies intuition, insight, and enlightenment. When paired together, 11 11 is a clear message from the universe to become conscious and aware" (truththeory.com). This is why every day from Saturday, June 6 through Friday, June 12, “Transform Through Covid-19” will start at 11:11 am with a grounding meditation to start the day led by Surrendered Healing Founder and Spiritual Healer, Adelina Tancioco. Next will be three 20-minute sessions from healers of color from across the country representing the Bay Area, Los Angeles, Fort Washington, and the Bronx. Each day will end at 12:45 pm with 15 minutes of rhythmic movement led by Meredith Curry, Owner of AdvancED Consulting, LLC, and music by Shanta Franco-Clausen, a.k.a. DJ Shugga Shay. “Our work is sacred and so are we,” shares Tovi Scruggs-Hussein, Educational Leader & Healer with Tici’ess, Inc. in Oakland, CA who will lead a session called “$tackin' for Spirit: Keeping Your Money Conscious, Connected , and Courageous.” We invite you to be a part of this virtual healing community by registering for “Transform Through Covid-19” and enjoying one day, or everyday of the week-long event. This is for you if:

To learn more and register, go to www.advancedconsulting.org/pop-up-healing-center. Read the profiles of the event speakers and explore nearly two dozen sessions. Fawad Akbar, Owner of Body Evolution in Newark, CA believes, “Two things define you. Your patience when you have nothing, your attitude when you have everything,” and he will share this with us in practice in his session “Full Body Workout with Body Evolution.” “Transform Through Covid-19” is proud to partner with AAPI Women Lead founders Dr. Connie Wun and Jenny Wun who will lead a day of Healing & Solidarity. “What is meant for you cannot be unmeant for you,” shares Jenny who will lead a session with her sister called “Healing & Solidarity.” The event also promotes a fundraiser to support the Liyang Network during COVID-19. 100% of contributions will go to services, resources, and supplies for the Lumad, the indigenous people of Mindanao, Philippines. “Lumad” means “native of the land” in Cebuano. In celebration of the Lumad and all Filipino cultures, there are healers offering sessions like "BAKS NAMAN! Self Care through Boxing;" "Dalawang Buslo, Two Baskets: Integrating Stress & Joy in the Present Moment;" and "Hilot Through Story." For more information about Transform Through Covid-19: A Virtual #PopUpHealingCenter with 21 Healers of Color or to arrange an interview with the co-hosts Meredith Curry and Adelina Tancioco, please contact Meredith directly at [email protected]. ### Meredith “Mer” Curry is the Owner and Principal Consultant of AdvancED Consulting, LLC. Mer’s mission is to empower businesses striving to solve the world’s most complex issues through thought-partnership, education, and operational leadership. She also seeks to uplift organizations run by and/or actively promoting the betterment of hxstorically disadvantaged groups like minorities and womxn. Mer works with entrepreneurs, nonprofit and education organizations to increase capacity organization-wide. She works with their leaders and professionals to enhance fund development, board management, programming, data analysis, Salesforce, and general operations strategies and processes. For more information see www.advancedconsulting.org or follow Mer on LinkedIn and Facebook.

Back to Blog

7 MIN READ This article is the 4th in a series on "Financial Aid, College Choice, and COVID-19" The time is now to support our students and families through this financial aid conundrum and ensure they’re making the best choices for their futures. In the first article in this series, Financial Aid, College Choice, and COVID-19, I talk about the importance of all of us working together right now because as adults, as students, as human beings, if we’re going to get through COVID-19, it will be together. In the second article, I talk about how we face a Financial Aid Conundrum that is persistent, systemic, fraught with pitfalls ready to take advantage of families, and overbearingly complex to tackle. I talk about this now because this issue is facing our students right now as they prepare to choose what college they will go to by the College Decision Day deadline of May 1 for many California public and independent four-year institutions. When all is said and done, though, we must keep in mind the Power of Student Resilience and Choice. That's why in this fourth article, I want to address the students so that they can recognize this power. I also address all adult allies so that we can support students in embracing said power. Students, you can do this!

“Take an entrepreneurial approach and focus on sectors that are growing. Even if these areas don’t align with what you imagined you’d be doing after graduation, cultivate a flexible and open mindset - this will be essential for students in a COVID-19 economy. Build your energy as if you’re preparing for a marathon not a sprint. In the weeks and months ahead, be patient with and kind to yourself and develop support systems. Consider the possibilities that may emerge (in time) for us as a society, when many communities and sectors begin to focus on rebuilding.” Allies, we can help them!Colleague Lara Fox, Senior Advisor at the Marin Community Foundation who served prior to that as the Founding Executive Director of uAspire Bay Area, has this advice for us adult allies and educators: "It's crucial that counselors both stay in regular contact with 12th graders and ensure that students know they can appeal their financial aid offers if family circumstances have recently changed. It's also essential that colleges prepare to respond to a likely increase in appeals, given that 22 million Americans have filed for unemployment in the past four weeks alone.” I know the financial side of college can be daunting and overwhelming and I just hope families and educators will work together to ensure our students make the most of their options. Allies, let’s help our students now as much as we can, while also thinking strategically about how to support future cohorts through this. If you are a college advisor, counselor, or educator, consider teaching your students financial literacy, especially now, but also much earlier in students’ high school careers. Next Gen Personal Finance (NGPF) has a curriculum called “Paying for College.” Here’s a snippet of what you can teach your students using NGPF's lessons:

Colleges, please consider your students!To colleges and university financial aid officers and advocates, thank you for keeping students at the center. Please continue to do so. Our colleges will also need to support families, now more than ever, so that they can advocate for the best deals that will lead to less debt and more degrees. The Community College League of California Financial Aid Office Operations Taskforce released the report “Increasing Student Access, Success and Equity: California Community College Student Focused Financial Aid Policies February 2020” with the following guidance. Though written for community colleges, they bear consideration for all higher education institutions.

And finally, some Best Practices they offer for higher ed:

Thank you for sticking through this series on Financial Aid, College Choice, and COVID-19! Good luck to the #ClassOf2020 and all non-traditional students who are preparing their choice for College Decision Day this year! To learn more about Moneythink, go to moneythink.org/. To learn more about Next Gen Personal Finance, go to www.ngpf.org/.

Back to Blog

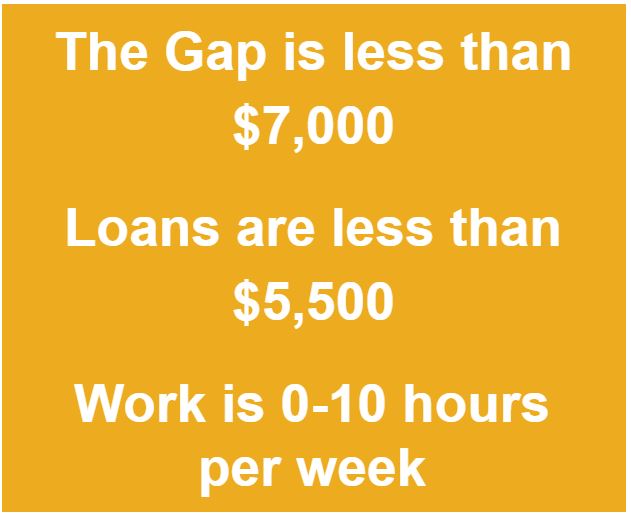

5 MIN READ This article is the 3rd in a series on "Financial Aid, College Choice, and COVID-19" COVID-19 will impact college decisions this year. National College Decision Day is historically on May 1. There are petitions to push back Decision Day to June 1 if not later. From the New York Times (March 15), the Washington Post (March 20), NPR (March 22), and CNBC (March 27), we hear that the college decision experience is impacting students and colleges alike with the cancelations of college visits and Admit Days nationally. Affordability is an even bigger concern today than it was prior to COVID-19 with less than ¼ of students having a high level of confidence in their ability to afford college now (Carnegie Darlet). Families’ investments are getting hit and both students and parents are less sure about how their jobs and paychecks can contribute to college expenses this fall. Students’ perceptions of where they want to go are changing. They’re considering less-expensive and local public schools over private universities far from their families, and 70% are thinking of staying within 3 hours (or 180 miles) from home (The Princeton Review). The American Council on Education has predicted a 15% drop in enrollment nationwide (and 25% international), and many institutions are preparing for the possibility of having to continue remote classes or delaying the start of the fall semester to reopen campuses (NY Times). How can you help your students and families navigate this crucial time in their lives, so that they can still take advantage of opportunities that are best for the student? Step #1: Choose a tool to analyze your student’s award letters. In the first article in this series, "Financial Aid, College Choice, and COVID-19," I introduce you to partner Moneythink. I recommend Moneythink’s coaching tool that you can download to Excel. It pre-populates information from most colleges that have public direct and indirect costs data and all you need to do is override it with any actuals your colleges provide in their letters! Why does Moneythink pre-populate information when other tools don’t? Because this highlights one of the main issues with financial aid award letters: they often have incomplete or misleading information. This could be in the form of information that is literally missing, like no reference to personal expenses or transportation, or no specific mention of PLUS loans though they are included in the package. Step #2: Have your financial aid advocates at the ready. Connect with your high school guidance counselor or college advisor. If you work with a college access organization you can reach out to your advisors and let them know you’re looking for help. Take advantage of free webinars like Moneythink’s Financial Aid Award Compare Webinars scheduled on April 21 for Advisors and April 23, 28, and 29 for Students & Families. Step #3: Collect and compare those awards! You don’t have to review all of your award letters at once. In fact, you should review them as you get them so that you can advocate as soon as possible when you need to! The sooner that you appeal when it is the right move, the better. As you get the awards, compare them. Did College B offer you a better package (comparing gift aid to direct costs) than your first choice, College A? Get your appeal package together and let College A know about College B’s offer. See if they’ll budge! For more tips on appeals, check out SwiftStudent which helps you write your financial aid appeal letters for free. Step 4: Advocate! Advocate! Advocate! Students are unaware that funding sources can vary year to year. Families often don’t know to ask if the institutional grant they were awarded is renewable for future years. Sometimes they don’t know to ask their scholarships where their money is going, and this matters because some colleges will take scholarship money reported to them and we’ll see a case of financial aid displacement. This means the colleges reduce the amount of gift aid like grants by the size of the scholarship. Advocate for the best awards by ensuring they’re basing it off the most up-to-date information, appealing if you have a qualified circumstance, and applying to as many scholarships as possible. Do what you can to fill whatever gap is standing in the way of you and your college. But be sure you’re thinking about more than just this year. Ask all the questions you need to so that you understand what financial aid could look like for your 2nd year and future years. Colleges often offer very appealing first-year packages but they start to look different in the 2nd year. That’s why groups like AAUW San Jose have a scholarship just for college juniors and seniors! Step 5: Take out only the necessary loans and work study. Loans can be a very important, necessary, and positive investment in your future. Taking out more loans than you need to, however, can be costly. There is also an opportunity cost when you work more hours than will allow you to focus on your studies. The guidance from Moneythink for a college to be affordable is:

So be sure to pay attention to affordability, but don’t lose sight of other things that matter to you about the campus. Factors like the diversity, the culture, whether they offer the major or program you like, on- and off-campus activities, and whether or not you can really “see” yourself learning and growing there (whether you stick to the original major or not). Lastly, whichever college you decide to pursue, if you believe the Enrollment Deposit is a barrier for you and your family, advocate for yourself. The National Association for College Admission Counseling (NACAC) has released a new form for counselors, college access advisors, students and their families: Enrollment Deposit Fee Waiver Form. This form allows a student to request that their enrollment fee be waived due to financial circumstances. Enrollment deposits can be as low as $200 to as high as $600 (or even higher!), which can be a barrier, especially for low-income students. While everyone can use this form, each college can manage their own policies, choosing whether or not they will accept this form. I believe that there are student-focused financial aid officers out there waiting to support you through these challenges, so if you’re ready to make your final decision but you can't come up with the deposit money for your preferred college, submit the Enrollment Deposit Fee Waiver Form ASAP. I highly recommend that you do this before the deadline. Not sure when the deadline is? Check NACAC’s College Admission Status Update page with over 1,000 college updates so far. In the next article, I want to talk about Supporting Students and Families Through the Conundrum.

Back to Blog

3 MIN READ

"Thank you to my mother Helena Curry who instilled in me a strong work ethic, grit, and drive and paved the way by showing me what it means to be a true grassroots community leader and social justice advocate." Acknowledgments

I thank the partners of AdvancED Consulting, the Santa Clara County Commission on the Status of Women, the Santa Clara County Office of Women’s Policy, and the many local and statewide college, career, nonprofit, civic, and social justice advocates who shared contacts, made introductions, and dedicated time to provide all of the wonderful information listed in this guide. A big shout out goes to Amparo Diaz, Annie Do, and Michael Nuñez, all AdvancED Consulting partners, who supported the design and organization of content in this guide. Shout out to Kyra Young who designed all of the affirmation stickers and other AdvancED graphics you see throughout this guide and the AdvancED website and social media. Thank you to my partner (in life and career) Michael who supports me in all things and empowers me to be of service however I can as my authentic self. Thank you to my mother Helena Curry who instilled in me a strong work ethic, grit, and drive and paved the way by showing me what it means to be a true grassroots community leader and social justice advocate. Thank you to my cousins Janella Parucha, Justin Parucha, Melinda Parucha, and Evita Dupitas who inspire me to be myself and love myself. Thank you to my aunt Hedy Parucha and uncle Ben Parucha for their constant love and support. Thank you to mentors like Dwayne, Claudia, Coleetta, Sr. Susan, Gloria, Allison, Tessa, MB, Trisha, Dr. London, Masai, Elroy, Eric, Kevin and so many more for your wisdom, selfless coaching, and well-intentioned feedback. Thank you to great friends and colleagues like Lara, Gina, Erin, Meo, Serei, SJ, Alerie, Rod, Kadar, Matt, Meghann, Andrea, and Anthony for the strength you give me, each other, and the world, with all of your unique gifts and strengths. |

Photo from CityofStPete

RSS Feed

RSS Feed