ADVANCED ON PURPOSEAn educational blog with purposeful content. We welcome open and polite dialogue, and expect any comments you leave to be respectful. Thanks! Archives

May 2023

Categories

All

|

Back to Blog

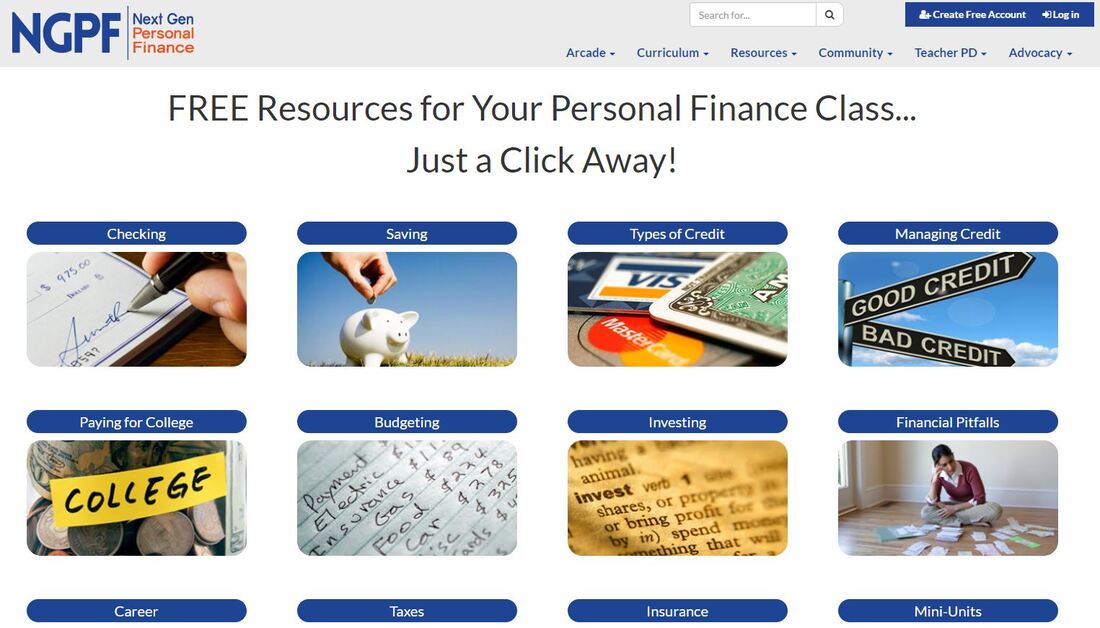

4 MIN READ This article is the 1st in a series on "Financial Aid, College Choice, and COVID-19." The power of “friendraising” has never been more real than in a recent introduction by a local education advocate which led to a podcast interview. I’m here to tell a story that starts with education colleagues making connections, and ends with the power of student resilience and choice. In this series, I start first with the alchemy of networking and friendraising because as adults, as students, as human beings, if we’re going to get through COVID-19, it will be together. Thus, I start with a Tale of Six Colleagues. As I continue the series, I wish for high school seniors, transfer students, parents, educators, and their allies to know that when it comes to financial aid and college choice, we face a Financial Aid Conundrum that is persistent, systemic, fraught with pitfalls ready to take advantage of families, and overbearingly complex to tackle. I then want to take a hopeful stance by talking about the Power of Student Resilience and Choice. I want students, and all of your allies, to understand that in your hands is the power to choose the best fit college for you based on what’s both affordable and a strong match. Lastly, I will close with how we can all support students through this, whether you are a student or an ally. Supporting Students & Families through the Conundrum means securing the futures of our communities, our cities, our counties, our states, our nation, and our world. Again, we are all in this together. Let’s begin with why networking matters. If you already know why networking matters, you can skip ahead to the meat of this series with the Financial Aid Conundrum. A Tale of Six Colleagues It started with me (Colleague #1) reaching out to Todd Hicks (Colleague #2), Director of University Access and Success at Cristo Rey San Jose. Thanks to my career development and college access related projects with partners Management Leadership for Tomorrow and Moneythink, and general volunteer work across Santa Clara County, I had more than one reason to sit down with this local educator. Cristo Rey San Jose is a member of the Cristo Rey Network which has 37 schools across 24 states. At the time I was in conversations with Todd about how to best support first gen students, I was in the planning stages of financial aid award review webinars with CEO Joshua Lachs (Colleague #3) of Moneythink. Moneythink empowers students to invest in the future by building technology that clarifies college finances. Thanks to Joshua’s leadership and his star-studded team at Moneythink, we were planning to host financial aid webinars in late April to support graduating high school seniors across the country through a crucial date that is fast-approaching: College Decision Day. One conversation in Todd's well-organized office turned into multiple emails, text, and phone calls excitedly charged around the topics of educational equity, access, and student success. In our most recent insightful encounter, Todd introduced me to Christian Sherrill (Colleague #4), Director of Business Development and Advocacy at Next Gen Personal Finance (NGPF). Appreciating every opportunity to meet a Teach for America Corps Member continuing to do great work for underserved populations, I eagerly scheduled our chat. Reaching more than 2 million students nationally by serving 25,000 middle and high school teachers, I was thrilled to learn more about their free personal finance curriculum and professional development offerings. Christian shared that NGPF’s mission “is to revolutionize the teaching of personal finance in all schools and to improve the financial lives of the next generation of Americans.” This wonderful chat with Christian in March turned into an introduction to NGPF Co-Founder Tim Ranzetta (Colleague #5) who also runs a “Tim Talks To…” Podcast. I was thrilled to listen to some of the episodes, such as Demetria Gallegos of WSJ on 9 Myths About Credit Scores from January 10, 2020 and Melissa Santoyo on the importance of financial education for first-gen students from November 29, 2019. Listening to Melissa’s podcast got me super excited for my chat with Tim because something she said really struck me: "I think that we need to prioritize teaching kids how to read financial documents, how to interpret them, how to walk into a college application process feeling at least a little bit more confident about the things we're in control of... when it came to the financial documents, I felt rather helpless. Because, you know something that was supposed to be in my control, something that I should have been able to fill out and then move on with my day, that wasn't the case. It carried this immense panic, and stress and anxiety and worry, further exacerbating the general horrible feeling of the college application process. So something needs to be done, and it needs to be done earlier on." When Tim asked me how I learned about Moneythink, I was pleased to share that it was through a mutual connection, Lara Fox (Colleague #6), Senior Advisor at the Marin Community Foundation who served prior to that as the Founding Executive Director of uAspire Bay Area. Lara not only introduced me to Moneythink, she also mentored me through my first year as a consultant. With connections made, Tim interviewed me for his podcast. What I shared then is a snippet of what you'll read in this series.

Now we’ve come full circle! On to the challenge at hand...the Financial Aid Conundrum.

1 Comment

Read More

I love that you talked about how students can actually have the power to choose the college or school they wanted which can be affordable and would be a good match for them. I guess this can be more achievable for those who are financially challenged if they get college financial aid assistance. This is perfect for those who wanted to pursue a career with an expensive cost such as taking medicine.

Reply

Leave a Reply. |

Photo from CityofStPete

RSS Feed

RSS Feed