ADVANCED ON PURPOSEAn educational blog with purposeful content. We welcome open and polite dialogue, and expect any comments you leave to be respectful. Thanks! Archives

May 2023

Categories

All

|

Back to Blog

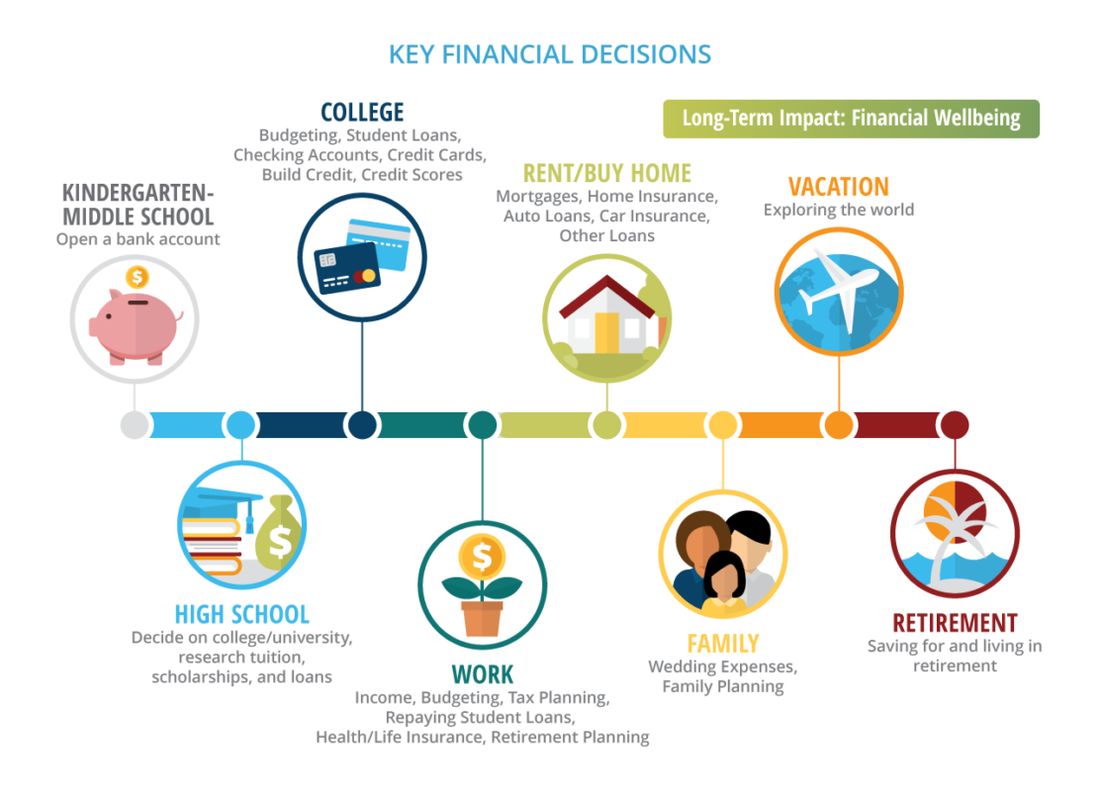

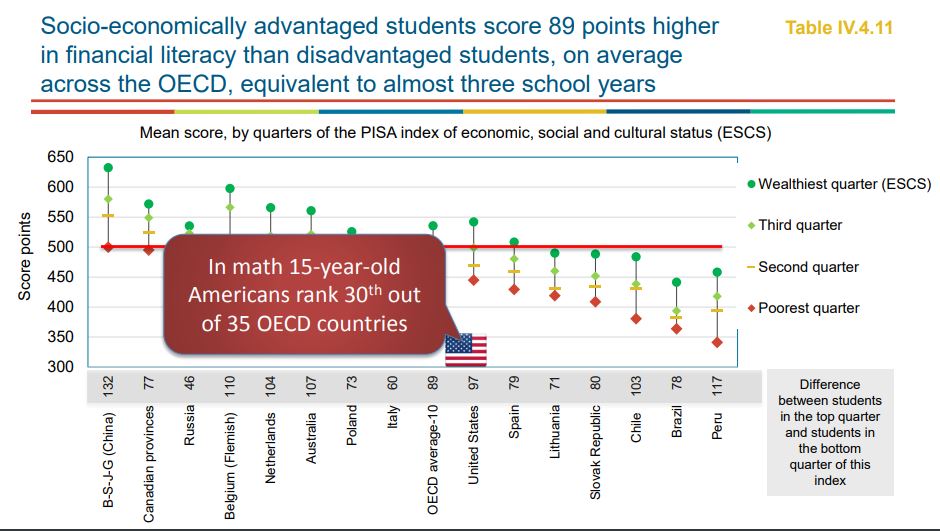

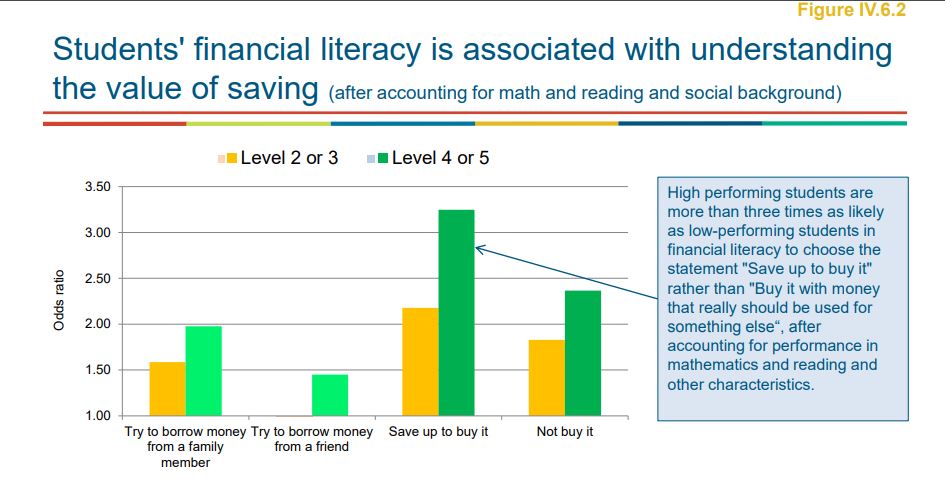

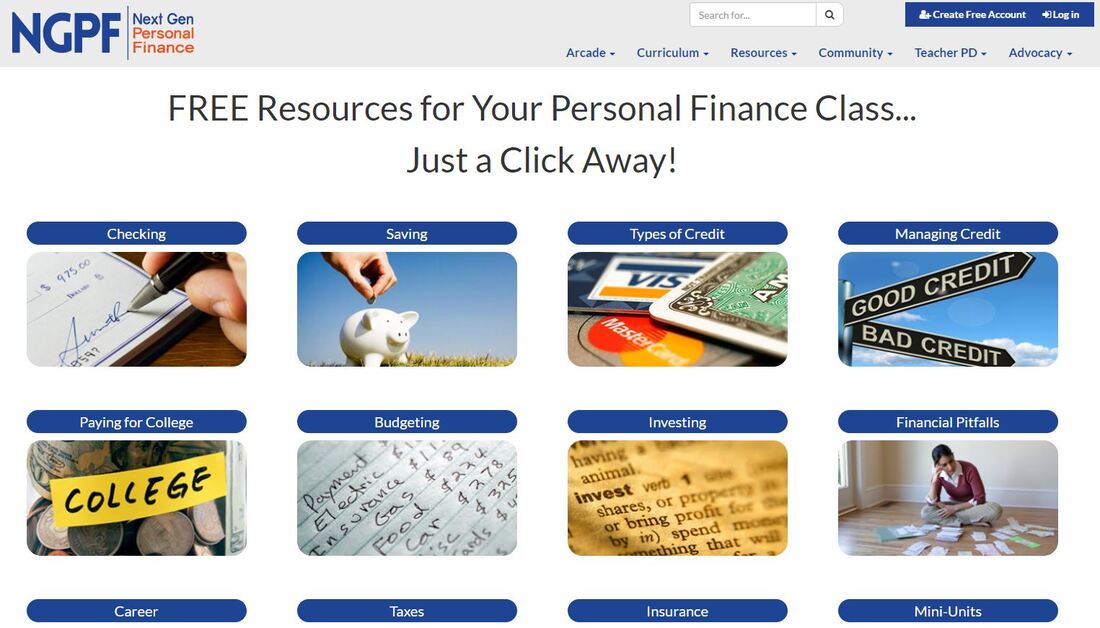

The Financial Aid Conundrum4/15/2020 13 MIN READ This article is the 2nd (and longest!) in a series on "Financial Aid, College Choice, and COVID-19" There are a lot of key financial decisions that we need to make as humans in this country. As you’ll see from the image below, they really start in high school with college-related decisions. When I think of this time in our high school seniors’ (and non-traditional students’) lives and put myself in their shoes, the two questions that come up for me are: 1. Am I going to college this Fall or Spring, and 2. If I am going to college, where? There is actually a third question, since there is a financial component to both questions. That question is 3. Depending on where I go to college, how much will I have to pay to go there? and this question is what I refer to as the Financial Aid Conundrum. It’s a conundrum because, firstly, I really enjoy that word and have few opportunities to use it. Secondly, because the synonyms for conundrum are in line with what students, families and educators face when it comes to financial aid, synonyms like “enigma,” “mystery,” “brain-teaser,” and “problem.” In the first article in this series, "Financial Aid, College Choice, and COVID-19," I talk about the power of networking and how I learned about Next Gen Personal Finance (NGPF) and their podcast "Tim Talks To..." In one podcast, what Melissa shares with Tim Ranzetta gets at the heart of what college-bound high school seniors are struggling with RIGHT NOW, and with 3.7M high school seniors expected to graduate from high school this 2019-20 school year according to the National Center for Education Statistics, it will require a huge, coordinated, all-hands-on-deck approach. Let’s all work together, utilizing all the expertise and tools in our toolbelts to support all these seniors through not just high school graduation, but also through important decisions that will impact their futures. Because many of these decisions are FINANCIAL. Here is the financial conundrum broken down into three (3) issues. Grab a seat and get comfy. Issue #1 This issue affects all students, but disproportionately for low-income students of color. Moneythink has done a ton of research on this issue, and there’s plenty of great information out there speaking to the issues of college persistence and student debt. Here are three facts we want you to know:

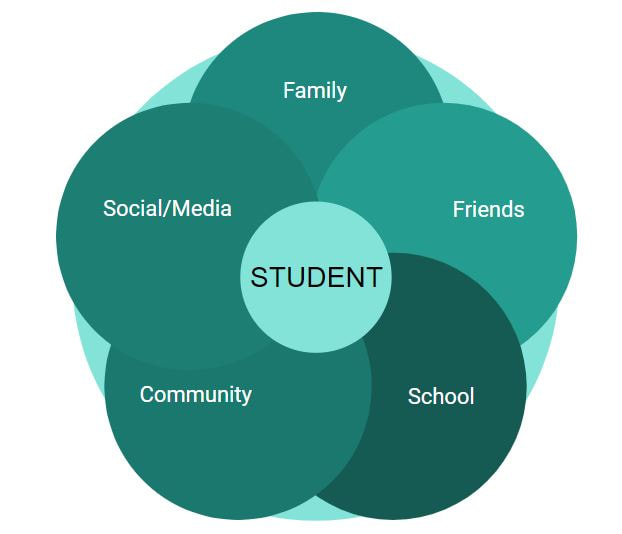

What does this all mean? That despite our best efforts to get students to college, especially first-generation students, they are ending up with too much debt and the lack of clarity about financial aid is largely to blame. Debt is a huge persisting problem since so few colleges are considered affordable to students struggling the most to pay, and to make things worse, students end up with debt whether they get their certificate or degree or not. If students are choosing (though, we argue, without a clear understanding) to go to unaffordable colleges, they are more likely to drop out because of financial reasons. If they knew they were doing this, would they willingly take out thousands of dollars in loans without the promise of an actual degree to make it worth their investment? Most of us education advocates, advisors, and counselors would argue of course not. So the question is, how do we get students to be more informed and empowered owners of their college choices? Let’s first look at how students understand this choice, and who helps them to understand.

In Moneythink’s College Success Report which they published in 2016, student interviews revealed two driving factors of students’ financial vulnerability:

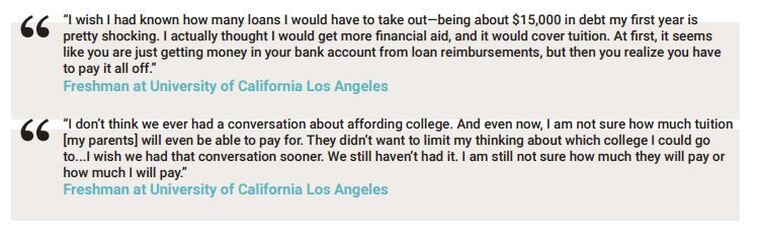

Students are also not having open and honest conversations with their parents about how they will be paying for college, and not because they don’t want to, sometimes because they just don’t know how to. While as allies and advisors, we might want to be in these conversations with each and every student to guide and support them, it’s just not possible given our bandwidth. I recommend resources like Moneythink and CaliforniaColleges.edu that offer talking points for students on how to talk to their families about money. Tools to bring clarity to families Even if a student has open and honest dialogue with their families about money, the process of reviewing and analyzing financial aid awards is still very convoluted, and unnecessarily so. The financial aid award is the only document that will tell families how much college will cost. Unfortunately, despite the availability of an aid template provided by the Department of Education to both simplify and clarify financial aid, colleges have their discretion to use whatever manner of jargon and incomplete information makes sense for their cultures, which leads to misleading information that often prevents families from using them effectively to make informed, intentional decisions. According to a report by New America & uAspire:

The Department of Education offers comparison tips on its website, and the National Association of Student Financial Aid Administrators (NASFAA) offers a worksheet, which students and families can print out, to help keep information about different colleges organized. Community capacity The research shows us that our community doesn’t have the capacity to provide quality college advising and counseling when it comes to financial aid, even with the best intentions at play:

Despite the best efforts of our colleagues in the field, financial aid is incredibly confusing, it changes on the regular, information from the powers that be don’t regularly or clearly trickle down to the people on the ground that need to disseminate the information to students, and training is not readily available to solve for the lack in knowledge and experience. The Powers That Be The Federal Student Aid office has recommended that colleges include the cost of attendance in aid letters and clearly distinguish between grants and scholarships, which don’t need to be repaid, and loans, which do. (Federal Student Aid) The Powers That Be, or the colleges that are designing and distributing their financial aid award letters, are recognizing the problem but are operating on their own timelines and priorities to solve this issue for students. Now that we’ve fully discussed why the Financial Aid Conundrum is such an issue not just for all students, but especially for low-income, first gen students, let’s look at the remaining issues because yes, there are still more. Issue #2 College decisions don’t focus enough on the financial considerations and implications. College decisions are about both WHERE a student is going to spend the next 1-6 years of their next academic and career journey, and HOW MUCH they are going to pay over time as an investment in their future. The process of evaluating financial aid awards requires multiple complex steps. Every single one of these steps requires a level of maturity and mathematical savvy, and for the right information to be in students’ hands all at once. In Moneythink’s interviews spanning thousands of students, many students shared that they were left unassisted and confused during the process. In many cases, students were not adequately prepared for college. In some cases, students received the help that they needed to be accepted into the school of their choice, thanks to the support of well-intentioned family, engaged college counselors, and available college access programs. Unfortunately, they were often expected to figure out the rest once they got to college, especially when it came to the finances.

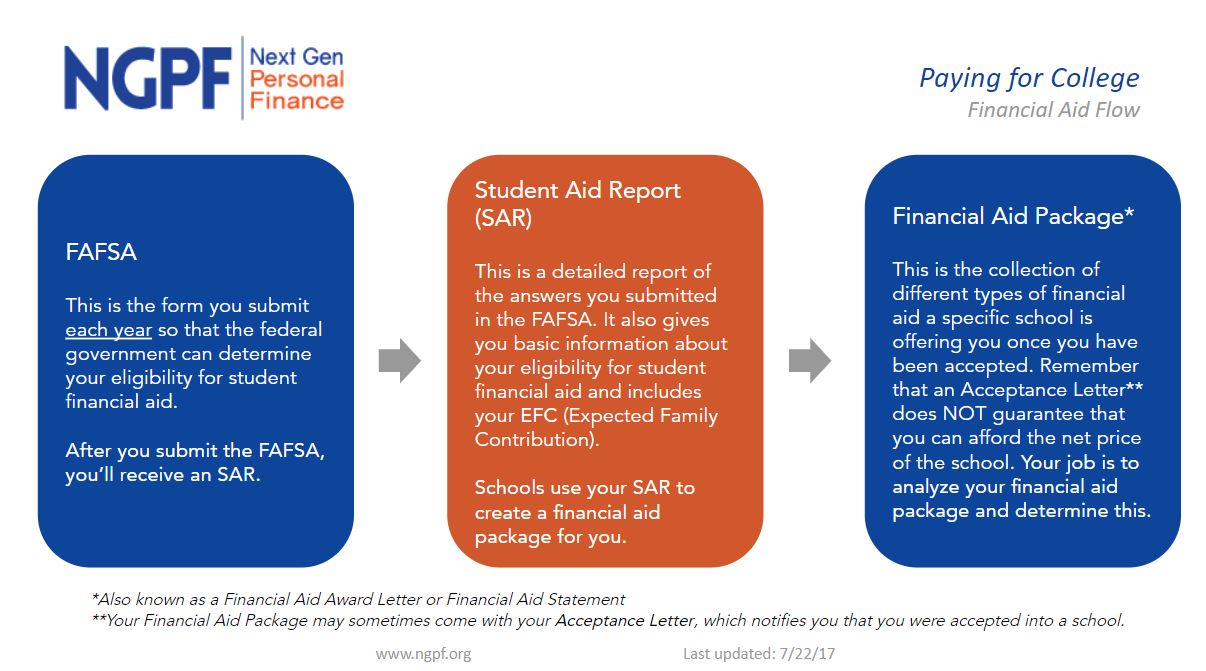

Organizations like ScholarMatch, Students Rising Above, Richmond Promise, the Early Academic Outreach Program (EAOP), Destination College Advising Corps, and more, serve students during the crucial transactional steps of their senior year and will walk students step-by-step through the financial aid application process. Once students complete their FAFSA, they will receive a Student Aid Report (SAR) and that will offer an Expected Family Contribution (EFC). A student EFC of zero (0) is the lowest possible value, and it means that the family has no ability to contribute to the student’s education. The highest EFC is $99,999. After a student submits their FAFSA, they may be asked for more information. This is called Verification. The SAR will note if the student has been selected for verification, or the college may contact the student directly. “Verification is the process your school uses to confirm that the data reported on your FAFSA form is accurate. If you’re selected for verification, your school will request additional documentation that supports the information you reported.” (Federal Student Aid) Once you’ve made it through verification, you should have a final award letter, as opposed to an award estimate. You will need to review this award letter so that you understand:

Earlier I shared that there are tools out there to help figure out the financial aid award review process. The problem, however, isn’t the lack of tools to help clarify and make sense of award letters. There are tools out there like the FinAid Letter Comparison Tool (with an advanced version available), BigFuture’s award tool, or CaliforniaColleges.edu’s use of the CollegeOPTIONS’ Financial Aid Award Comparison Tool. The real problem is that, while tools exist to compare financial aid awards for multiple colleges, these tools often require:

There is no tool out there that supports students and families in better understanding their financial aid award letters that does not also require them to manually enter that information into some document. This is fraught with user error and is a barrier to entry in multiple ways (lack of technical skills, variance in how award letters name and describe aid, incomplete awards, etc.). This is why I’m excited for Moneythink’s award compare tool coming out in October 2020 that will let you take snapshots of your awards for a super-fast analysis! Want to learn more about it? Click here to get on Moneythink’s listserve! Issue #3: Students often don’t realize just how much power they have in their college choice.

Despite all this challenge and calamity, there is still hope! Students DO have the power of their choice. Students DO have the time and opportunity to look at all the information available and make an informed, intentional decision about where they’re going to go this Fall or Spring. Students CAN and SHOULD resolve to make choices in their best interest that help meet goals they have designed for themselves. And as the parents, advisors, counselors, educators, coaches, guardians, and adult allies in their lives, we CAN and SHOULD resolve to support them however we can to make the best, most affordable decision possible. In this next article, I want to talk about how students can do this. It’s time to talk about The Power of Student Resilience and Choice because you DO have choices as a student. Students: The power to choose IS ALL YOURS.

3 Comments

Read More

Back to Blog

4 MIN READ This article is the 1st in a series on "Financial Aid, College Choice, and COVID-19." The power of “friendraising” has never been more real than in a recent introduction by a local education advocate which led to a podcast interview. I’m here to tell a story that starts with education colleagues making connections, and ends with the power of student resilience and choice. In this series, I start first with the alchemy of networking and friendraising because as adults, as students, as human beings, if we’re going to get through COVID-19, it will be together. Thus, I start with a Tale of Six Colleagues. As I continue the series, I wish for high school seniors, transfer students, parents, educators, and their allies to know that when it comes to financial aid and college choice, we face a Financial Aid Conundrum that is persistent, systemic, fraught with pitfalls ready to take advantage of families, and overbearingly complex to tackle. I then want to take a hopeful stance by talking about the Power of Student Resilience and Choice. I want students, and all of your allies, to understand that in your hands is the power to choose the best fit college for you based on what’s both affordable and a strong match. Lastly, I will close with how we can all support students through this, whether you are a student or an ally. Supporting Students & Families through the Conundrum means securing the futures of our communities, our cities, our counties, our states, our nation, and our world. Again, we are all in this together. Let’s begin with why networking matters. If you already know why networking matters, you can skip ahead to the meat of this series with the Financial Aid Conundrum. A Tale of Six Colleagues It started with me (Colleague #1) reaching out to Todd Hicks (Colleague #2), Director of University Access and Success at Cristo Rey San Jose. Thanks to my career development and college access related projects with partners Management Leadership for Tomorrow and Moneythink, and general volunteer work across Santa Clara County, I had more than one reason to sit down with this local educator. Cristo Rey San Jose is a member of the Cristo Rey Network which has 37 schools across 24 states. At the time I was in conversations with Todd about how to best support first gen students, I was in the planning stages of financial aid award review webinars with CEO Joshua Lachs (Colleague #3) of Moneythink. Moneythink empowers students to invest in the future by building technology that clarifies college finances. Thanks to Joshua’s leadership and his star-studded team at Moneythink, we were planning to host financial aid webinars in late April to support graduating high school seniors across the country through a crucial date that is fast-approaching: College Decision Day. One conversation in Todd's well-organized office turned into multiple emails, text, and phone calls excitedly charged around the topics of educational equity, access, and student success. In our most recent insightful encounter, Todd introduced me to Christian Sherrill (Colleague #4), Director of Business Development and Advocacy at Next Gen Personal Finance (NGPF). Appreciating every opportunity to meet a Teach for America Corps Member continuing to do great work for underserved populations, I eagerly scheduled our chat. Reaching more than 2 million students nationally by serving 25,000 middle and high school teachers, I was thrilled to learn more about their free personal finance curriculum and professional development offerings. Christian shared that NGPF’s mission “is to revolutionize the teaching of personal finance in all schools and to improve the financial lives of the next generation of Americans.” This wonderful chat with Christian in March turned into an introduction to NGPF Co-Founder Tim Ranzetta (Colleague #5) who also runs a “Tim Talks To…” Podcast. I was thrilled to listen to some of the episodes, such as Demetria Gallegos of WSJ on 9 Myths About Credit Scores from January 10, 2020 and Melissa Santoyo on the importance of financial education for first-gen students from November 29, 2019. Listening to Melissa’s podcast got me super excited for my chat with Tim because something she said really struck me: "I think that we need to prioritize teaching kids how to read financial documents, how to interpret them, how to walk into a college application process feeling at least a little bit more confident about the things we're in control of... when it came to the financial documents, I felt rather helpless. Because, you know something that was supposed to be in my control, something that I should have been able to fill out and then move on with my day, that wasn't the case. It carried this immense panic, and stress and anxiety and worry, further exacerbating the general horrible feeling of the college application process. So something needs to be done, and it needs to be done earlier on." When Tim asked me how I learned about Moneythink, I was pleased to share that it was through a mutual connection, Lara Fox (Colleague #6), Senior Advisor at the Marin Community Foundation who served prior to that as the Founding Executive Director of uAspire Bay Area. Lara not only introduced me to Moneythink, she also mentored me through my first year as a consultant. With connections made, Tim interviewed me for his podcast. What I shared then is a snippet of what you'll read in this series.

Now we’ve come full circle! On to the challenge at hand...the Financial Aid Conundrum.

Back to Blog

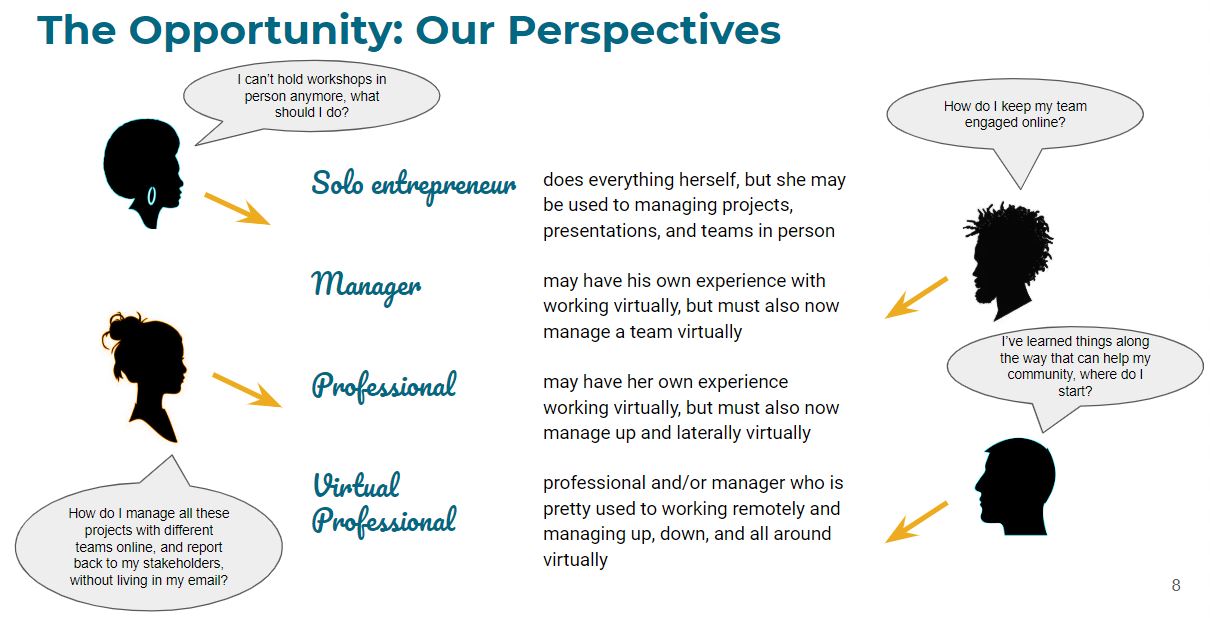

Transitioning to Remote Work3/18/2020 4 MIN READ In light of the disruptions caused by the coronavirus (COVID-19), many are finding themselves working remotely, getting laid off, having their hours reduced, and more. This article is focused on those who are able to continue working from home. For those of you who are looking for advice and resources because you cannot work from home, please Contact Me and let's take it from there. A recording of the Transitioning to Remote Work webinar on March 18 is available here (54:26). How should I tackle working from home?For whatever reason, we're working from home now. All hundreds of thousands of us. And we're all coming at this new reality from VERY different perspectives. Here are just a few of the perspectives I talk about on my webinar that goes with this Blog article. I'm sure there are many more where this came from.

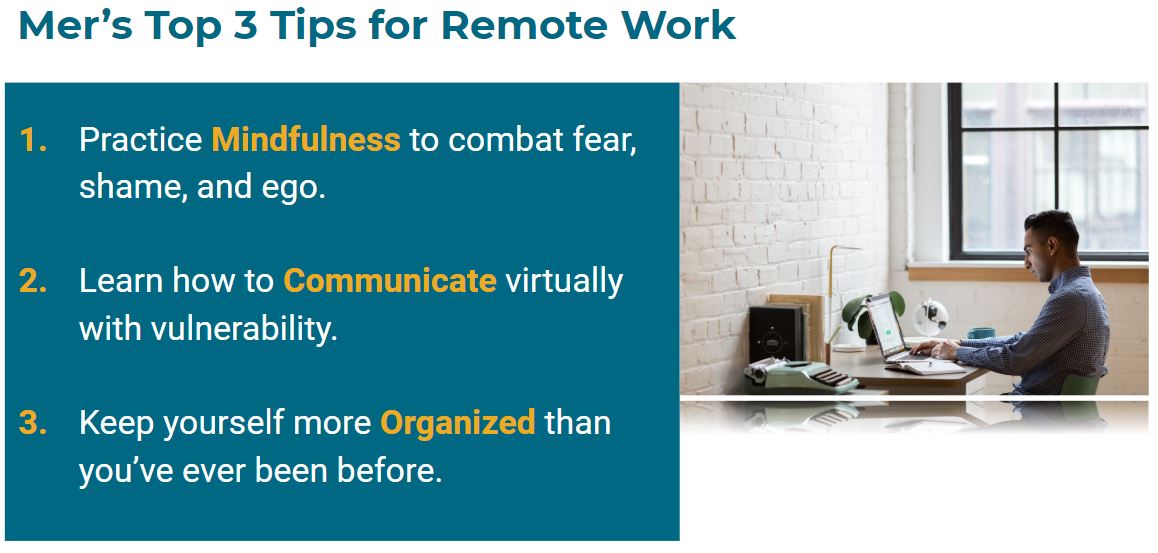

Once we have reflected on who we are and where we're coming from, we should take a deep breath because we understand 1) our own level of comfort and acumen working remotely, 2) my company's level of comfort and acumen working remotely, and 3) my ecosystem's level of comfort and acumen working remotely. It's important to know these three things because then you will know the #1 thing: It is NOT 100% your responsibility to figure this out. It's only 1/3 of your responsibility. Now that you believe that, you can focus on where you have control, and the first place you have control is how you tackle remote work. For this I offer you: Mer's Top 3 Tips for Remote Work. For Tip #1 for Remote Work, I discuss Mindfulness. Here is what you need to know:

For Tip #2 for Remote Work, I share Mer's Tips for Over-Communicating. Some of these include:

For Tip #3 for Remote Work, I discuss Organization. A few ways to get even more organized than ever include:

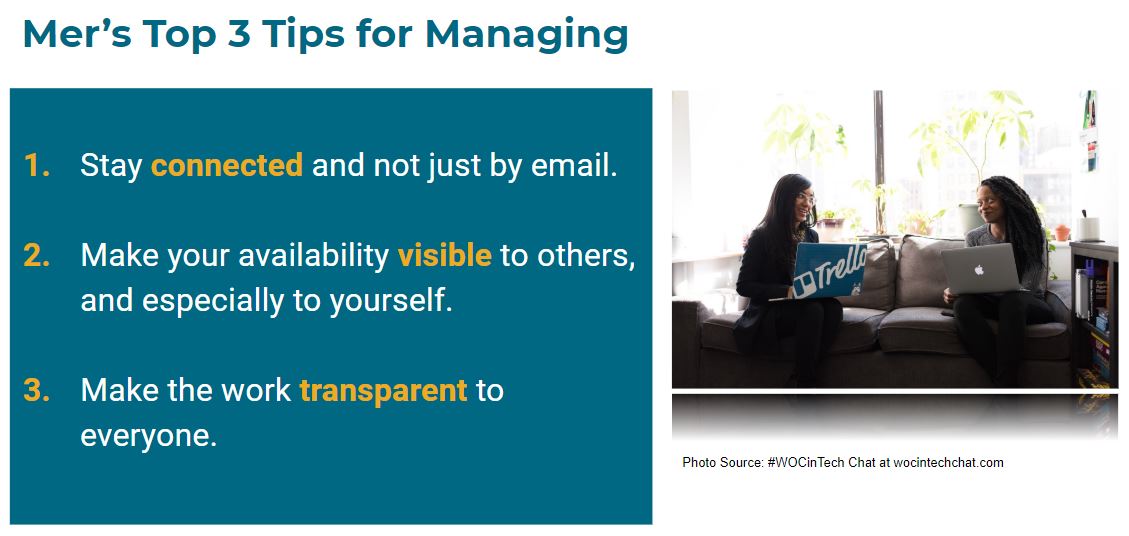

Next, I offer: Mer's Top 3 Tips for Managing. For Tip #1 for Managing, I discuss Staying Connected. You will need to take advantage of tools like Salesforce, Quip, Slack, and more to make connection possible. You'll also need to be more strategic with your meetings, which could include:

For Tip #2 for Managing, I share how to Be Visible. You will need to develop and/or refine routines like:

For Tip #3 for Managing, I share how to Be Transparent with Mer's Tips for Over-Documenting. Some of these include:

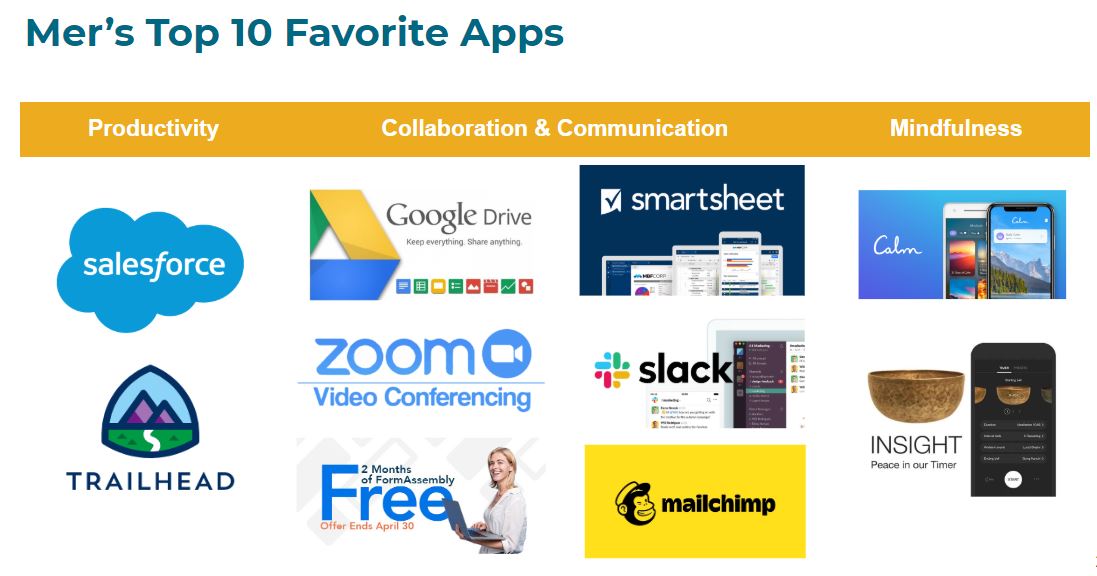

Lastly, I would like to share: Mer's Top 10 Favorite Apps. Rather than go through them in detail in this article, you'll find their logos below. You can learn more about them in the AdvancED Toolbox and in my handout Transitioning to Remote Work: Resources. You can also Contact Me with any questions or to ask for recommendations. The first Transitioning to Remote Work webinar was hosted on Wednesday, March 18 at 6:00 pm PDT. Click here for the recording (54:26)! The next webinar is on Thursday, March 26 from 11:30 am to 1:30 PDT. Register on Eventbrite and join us, you can learn while you have your lunch!

Back to Blog

Holiday Last-Minute Gifts for Self & Others12/16/2019 5 MIN READ The holidays are here and gift-giving activities are fast approaching. You may be ahead of the game as I’ve tried to be in past years, or you could be way behind on your gift-getting as I happen to be this year. Wherever you are on your holiday shopping, one thing is almost always certain - you didn’t include the most important person on your list, YOURSELF. So in the spirit of last-minute holiday shopping, here are some tips and suggestions as you hastily make room in your bank account and your tree for presents for the loved ones in your life, which includes you. Tip #1 Gift Yourself This time of year can be filled with stress, grief, anxiety, and busy work. Consider giving yourself a self-care gift of time, rest, and relaxation. On my Self-Care page, you’ll find gifts like:

Tip #2 Buy a Book With so much to learn and so many stories told, why don’t we take a break from binge-watching our favorite shows and pick up a book instead! Whether you prefer audio books, reading from your Kindle, or holding a bound copy in your hand, a good book can be the needed respite from a busy life and stressful activities. In my Bookcase, you’ll find gifts like:

Books for the wonderful kids in your life include:

Tip #3 Make Something From the Heart Gone are the days when we could put our hands in some paint, stamp it on a card, write our name and “I love you!” next to it, and give that to a loved one as a gift. Or is it? We underestimate the value of a thing or work made with our hands and minds, but it continues to be one of the most thoughtful, personal gifts that we can give to someone. Here are just a few examples of gifts that I’ve seen people give as gifts, consider what makes sense for you and try something out of your comfort zone!

Poetry, short story, or other writing. I’ve done this for my partner, my Mom, and friends over time. This can be a poem typed and framed, or a printed book of short writings. You don't have to write something new if you have pieces folks have never seen before, bring something out of your treasure chest and make it shine with pretty font on fresh paper!  Arts and crafts of any kind. When was the last time you’ve gone inside Michael’s or Joann’s? My bestie Gina is a fantastic scrapbooker and she also makes dreamy ribbons and bows. My long-time friend Amparo (aka Apple) makes incredible gifts from the heart through crochet. If you check out Apple’s Instagram you’ll get some great ideas for crocheting, or you can reach out to the queen yourself for a special order! Tip #4 There is No Perfect Gift, Just Thoughtful Ones At the end of the day, let’s try to remember that it isn’t about how much money you spend, or if you even expect a gift from this person in return. It’s about what makes you grateful for having this person in your life, and the most natural, cost-effective way for you to show her or him that gratitude. To my Mother, my partner Michael, my grandma Trining, my cousins Janella, Melinda, Justin (may you rest in peace), Evita, Cristine & Mikey (and my second cousins Nate, Jon, and Lizzie), Cassandra & Matt, Dalton, Anna, my aunts and uncles Hedy & Ben, Hanny & Howard, Joel (aka Manoy), Elenore & Bernie, and family spread throughout the Philippines, US, Australia, and elsewhere, I’m thankful everyday to have you in my life and to be part of this beautiful, multi-cultural family! To my best friends Lara, Gina, Erin, Meo, Serei, SJ, Roy, Alerie & Rod, and friends all over the world, I’m grateful for you! To my mentors Dwayne, Sr. Susan, Kevin, Elroy, and so many more that have touched my life, thank you for your wisdom, your well-intentioned feedback, your selfless coaching, and your positive vibes. To you readers out there, I’m so thankful that you read whatever you read on my website, and I hope you have a blessed and joyful holiday season with your loved ones! About Author: Meredith "Mer" CurryMer has always had a passion for education and helping historically underrepresented groups achieve access and success to higher opportunities. She has consulted nonprofits, educational institutions, and businesses in addition to her volunteerism and mentorship of students.

Learn more about Mer at www.meredithcurry.com.

Back to Blog

A Review of GDPR and CCPA12/9/2019 5 MIN READ This article is the 2nd in a series. Read the introduction article: "Why Data Privacy Matters." So you know what your data looks like. You know what it is used for. You have a sense of who touches it and who uses it. Now what? Now, you educate yourself on data privacy. If you have data, you need to protect it. I had the opportunity to speak to this on a webinar hosted by FormAssembly on August 21, 2019. I joined Maggie Tharp at FormAssembly to talk about the data privacy landscape in 2019, and evolving regulations and best practices. Check out the Webinar Recap: California Privacy and How It Affects You. On the webinar, Maggie and I discussed The General Data Protection Regulation (GDPR) as well as the California Consumer Privacy Act (CCPA) which will go into effect on January 1, 2020. As FormAssembly’s guest presenter, I spoke to the implications for nonprofit and educational organizations who may not have people or processes in place to specifically track data privacy and how it impacts organizations. In my Webinar Recap, I share some key insights that I shared on the webinar. As a follow up to their Data Privacy Deep Dive Webinar Series, FormAssembly recently published their white paper, State of Data Privacy in 2019. In this guide, they talk about the data privacy landscape in the United States, the new data privacy laws in other U.S. states, where businesses stand, and tips on better data stewardship. A realistic next step to prepare for CCPA is to have a discussion with the relevant leaders of your organization and determine your level of preparedness. Review FormAssembly’s white paper, State of Data Privacy in 2019 and give your organization a rating of Very Prepared, Prepared, Somewhat Prepared, or Not Prepared. Depending on what your team decides, make a plan to move your team to Prepared or Very Prepared. I’d like to share some highlights from the guide, and weave in some of my own best practices. These tips come from working with small to large, local to virtual organizations across California in developing and implementing data privacy business processes and protocols.

Read my next article “How You Can Protect Your Data” (under construction) for more tips and tricks to manage and protect your data. Want support developing a data governance strategy? Data governance helps organizations manage their stakeholder data and protect it from being abused, stolen, or lost. AdvancED can help you design an effective data governance strategy that will describe the steps to analyze, secure, store, and manage your organization’s stakeholder data. Schedule your free 20-min consultation now. Related articles

About Author: Meredith "Mer" Curry Mer has always had a passion for education and helping historically underrepresented groups achieve access and success to higher opportunities. She has consulted nonprofits, educational institutions, and businesses in addition to her volunteerism and mentorship of students.

Learn more about Mer at www.meredithcurry.com.

Back to Blog

Why Data Privacy Matters12/5/2019 4 MIN READ This article is the 1st in a series on "Why Data Privacy Matters." I learned the importance of data starting in high school working at a local CPA firm in downtown San José during my summers. Making my way through rows of filing cabinets, building up a tolerance to papercuts, and sneezing my way through dusty file folders, I took numbers off pieces of paper and turned them into financial statements. Sometimes it was straightforward data entry. Other times I double-checked the math after translating illegible debits and credits into typed balance sheets and income statements. Today I am so adept at ten-key I can type rows of numbers without looking at the keypad. I am also so grateful now for Excel formulas, pivot tables, and tools like Salesforce and FormAssembly that can bring clarity, transparency, and automation to once complex and highly manual (and thus, fraught with human error) processes. In my over 10 years of being a certified Salesforce Administrator and over 20 years of championing Excel, I am a firm believer that the more data you can have at your fingertips, the more questions you can develop to find intelligent answers to. But in my years of working with corporations, startups, and nonprofits, I’ve seen varying levels of success making use of the data that is available. Often, the challenge isn’t just what to do with the data you do have, but how to get the data you really need for the scale and impact you want. This might mean taking a step back and asking yourself, “What data do I have now, what am I using it for, and how has that been helpful?” It might then lead you to ask more questions like, “What data should I continue to track, what questions will they answer, and how will that be helpful in the long-term?”

If as a professional, manager, or executive, you are not asking yourself these questions at regular intervals (I recommend quarterly if not annually), then I highly recommend that you start now. Once you go through this fact-finding mission of understanding what data you have and what it is used for, the next important question is, “How am I protecting it?” I’d like to give you the use-cases, best practices, and tools to develop an intentional action plan around data privacy to ensure you are protecting the data you have and the data you intend to collect. Read my next article “A Review of GDPR and CCPA” to learn about the most important regulations and legislations that inform the policies and practices you may need to develop around data privacy. Want support developing a data dictionary? A data dictionary is a document (Word, Excel, whatever suits your fancy) that describes the types of data collected, the sources, the intended uses, and how the data is stored, archived, and scrubbed/deleted over time. Let’s talk about how our advisors can help you customize a data dictionary for you that tracks all of your data elements from all of your sources (e.g. Google Analytics, Salesforce, Google Sheets, Excel). Schedule your free 20-min consultation now. Related articles

About Author: Meredith "Mer" CurryMer has always had a passion for education and helping historically underrepresented groups achieve access and success to higher opportunities. She has consulted nonprofits, educational institutions, and businesses in addition to her volunteerism and mentorship of students.

Learn more about Mer at www.meredithcurry.com.

Back to Blog

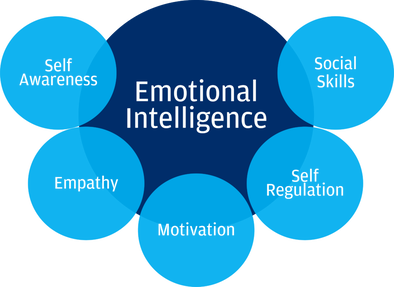

Defining Your Strengths as a Leader Series: #2 Defining Your Emotional Intelligence Strengths11/4/2019 3 MIN READ I found a recommendation for “Emotional Intelligence 2” by Travis Bradberry & Jean Greaves. With the book came a new and enhanced online edition of “the world’s most popular emotional intelligence test,” The Emotional Intelligence Appraisal®. The Emotional Intelligence Appraisal® provides you with a complete picture of your emotional intelligence. This includes an understanding of:

This appraisal will ask you specific questions about your behavior. How you answer these questions is for your eyes only. A true reflection of your emotional intelligence skills depends on your willingness to accurately rate yourself. This requires a lot of thought into how you are in many situations, not just the ones you handle well. When you read each question, create a clear picture in your mind of how you are in different situations, then answer honestly how often you demonstrate the behavior in each question. Define Your Emotional Intelligence Strengths Activity Read about the Emotional Intelligence Appraisal - Me Edition. Consider if you would like to take this assessment (it costs less for the hardcover book than the online assessment!). If you decide to take it, put it on your calendar by blocking 2 hours and set a reminder for a few days before so that you do not reschedule it.

What if you decide not to take it? Reflect on a colleague or loved one in your life who could benefit from the activity and tell them about it! The accompanying report recommends that I begin practicing on one specific area, Social Awareness, and offers three strategies to nurture my skills in this area:

My Take-aways on the Emotional Intelligence Appraisal

Now that you’ve reviewed one assessment, take a look at Assessment #3 the StrengthsFinder by Gallup (stay tuned!). Related articles

About Author: Meredith "Mer" CurryMer has always had a passion for education and helping historically underrepresented groups achieve access and success to higher opportunities. She has consulted nonprofits, educational institutions, and businesses in addition to her volunteerism and mentorship of students.

Learn more about Mer at www.meredithcurry.com.

Back to Blog

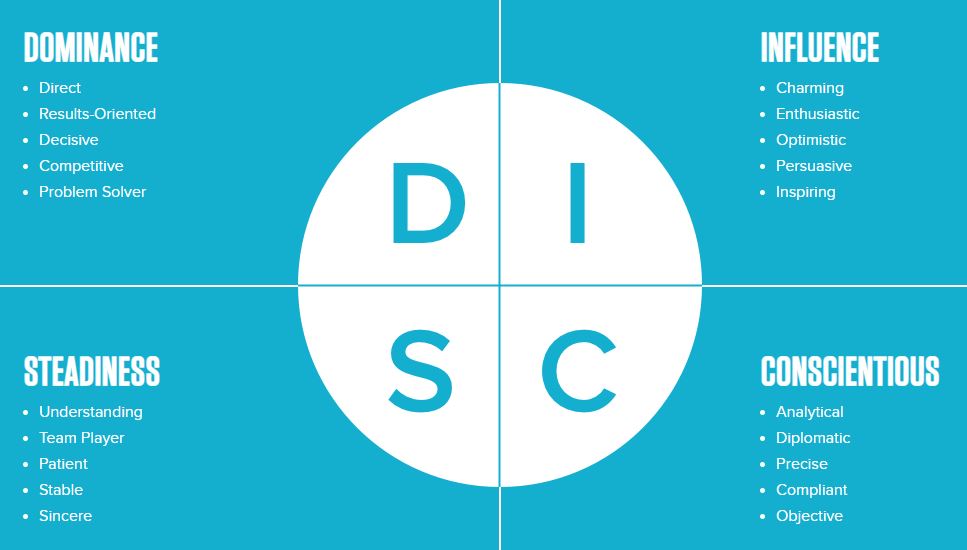

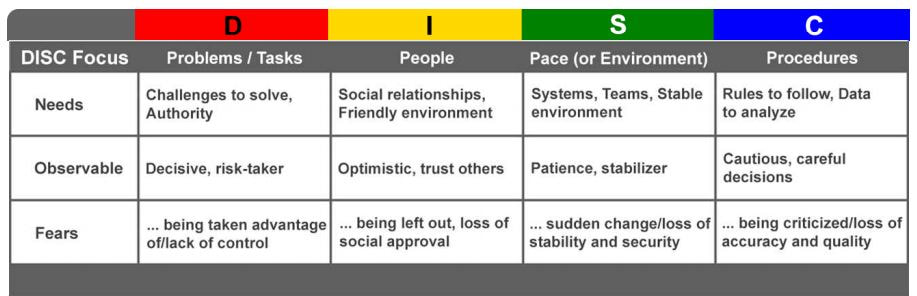

4 MIN READ This article is the 2nd in a series. Read the introduction article "Defining Your Strengths as a Leader." I took DiSC through the Tony Robbins website thanks to social justice comrade and career coach Anthony Le’s recommendation. I’ve participated in a Tony Robbins seminar as a teenager, so to take something as an adult almost 20 years later was exciting! DiSC is an observable “needs-motivated” instrument based on the idea that emotions and behaviors are neither “good” nor “bad.” Rather, behaviors reveal the needs that motivate that behavior. Therefore, once we can accurately observe one’s actions, it is easier to “read” and anticipate their likely motivators and needs. DiSC provides your ADAPTED style and NATURAL style, represented as graphs and word sketches. As an example, for People, the words that indicate my needs, fears, and what’s observable are:

Define Your Strengths with DiSC Activity

What if you decide not to take it? Reflect on a colleague or loved one in your life who could benefit from the activity and tell them about it! My Behavior Style is Assessor. Key behavioral insights that stand out to me that I will need to keep in mind to strengthen my relationships are:

The insights I get to take home with me and contemplate as I move forward are lists of “Help Them Tos” adapted for different situations such as At Work, In Social Settings, and In Learning Environments. Lastly, you get a summary of your motivation which tags seven (7) Motivators as Very Low to Very High. My breakdown was:

Knowing that Altruistic motivation is my highest, key universal assets that stand out to me that I will need to keep in mind are:

My Take-aways on DiSC

Now that you’ve reviewed one assessment, take a look at Assessment #2 on Emotional Intelligence. Related articles

About Author: Meredith "Mer" CurryMer has always had a passion for education and helping historically underrepresented groups achieve access and success to higher opportunities. She has consulted nonprofits, educational institutions, and businesses in addition to her volunteerism and mentorship of students.

Learn more about Mer at www.meredithcurry.com.

Back to Blog

Defining Your Strengths as a Leader10/28/2019 4 MIN READ  This article is the 1st in a series on "Breaking Knowledge Barriers". This article is the 1st in a series on "Defining Your Strengths as a Leader" I have read my fair share of what some might term “self-help” books. I like to think of them as “self-awaken” books. The “help” part in “self-help” alludes to something being broken that needs fixing. What I appreciate about the books I’ve read since I was little, as well as today, is that self-awaken books point to the strengths, potential, and inner wisdom deep inside of us, already alive and ready, yet often untapped and tucked away hidden from sight. This wisdom manifests as skills and intuition, and I’m keen on developing my ability to tap this wisdom. Self-evaluation is critical for me as a leader, as a manager of teams and projects, and as a woman of color. The Center for Creative Leadership reminds us in their report 7 Emerging Trends for Transformative Leaders that some managers may struggle with interpersonal relationships, affecting their ability to build and lead teams or adapt to change, which can lead to career derailment. To avoid this, “organizations must design programs that develop [managers’] self-awareness, political savviness, communication skills, and ability to influence others...skills that are essential to effectively heading a team.”

As a professional, whether you are an employee of a company or an entrepreneur, understanding your strengths and skill sets is key to building the confidence, resourcefulness, and grit to adapt to any situation. As human beings who have way more going on than just our jobs, you can bet that your personal, educational, emotional, societal, cultural, economical, and religious identities are often at play when you negotiate professional situations. Most of us do not know how these identities manifest themselves in our decisions, risk tolerance, and self-reliance. Most of us have comrades and loved ones we can turn to for advice and feedback, but our hearing is often screening and interpreting with the bias of that relationship and all of its power dynamics. So why take a personality assessment? Because we often don’t know the questions to ask. And even if we did, would we really answer honestly, free of unconscious bias, shame, guilt, regret, or fear? Define Your Strengths as a Leader Activity Take out a pad of post-its, ideally in two different colors (e.g. green and yellow). Find a blank wall or space where you can lay out two sets of post-its and set aside a total of one hour.

We know from the Council of National Psychological Associations for the Advancement of Ethnic Minority Interests “Test bias is a primary issue of selecting and using testing and assessment instruments with racial/ethnic minority groups. Past research has shown that tests can produce misleading results with culturally different groups in terms of slope and intercept (or unfairness) bias.” Thus, if you are a person of color, you will need an assessment that will address and consider this intersection of your identity, as well as many others, if you are to feel good about doing anything at all with the results. I’d like to give you a review of a few assessments because, 1) I have taken them in more than one sitting or format, and 2) I have heard from and worked with others who have taken one or a combination of assessments as part of developing themselves professionally at work. I have written a separate blog post for each assessment in this "Defining Your Strengths as a Leader" series. Click here to go to Assessment #1 on DiSC. Related articles

About Author: Meredith "Mer" CurryMer has always had a passion for education and helping historically underrepresented groups achieve access and success to higher opportunities. She has consulted nonprofits, educational institutions, and businesses in addition to her volunteerism and mentorship of students.

Learn more about Mer at www.meredithcurry.com.

Back to Blog

4 MIN READ This article is the 5th and final one in a series. Read the introduction article: "Breaking Knowledge Barriers Series: Womxn of Color in the Workplace." If you Acknowledge who you are, Accept the strengths and challenges in front of you, and develop a risk tolerance to Adapt to situations as they come, you’re in a pretty good place. But let’s go back to the first question that I had to ask myself - What Can I Give Up? This is why I say, Finish Strong. Finish whatever is holding you back with strength. This might be just what you need to move forward on something else. Be intentional about finishing whatever it is, and focus on ending it with a lesson to validate the effort.

spreadsheets and trade them in for Quickbooks Self-Employed or something:

Once you know the owner, size, and the priority of this project you want to START, you can rumble with vulnerability as the great Brené Brown advises in Dare to Lead. You can let go of the need for this project to look and feel a certain way if you’re going to delegate it. You can let go of the anxiety of thinking about it right now if you know it’s not going to come up again for several weeks. I bet you will also realize that you have mad delegation and prioritization skills as well! Lastly, Back Yourself Up by building a strong bench of people that you can rely on to support you. If you can set up a formal advisory or committee, awesome. If you can find a mentor, wonderful. If you can join a community like a local commission or network like the Women’s Networking Alliance or the Asian Pacific American Leadership Institute, way to step it up! The most important part is getting positive reinforcement and honest guidance from outside of yourself, while also building your inner monologue of positive vibes and affirmations. And whenever possible, build a diverse bench. It should have people that look like you and people that don’t look like you. It should have people that will agree with you on some things and people who will disagree with you on some things. Stack your bench with people who will look out for your best interest, which is not the same as Yes-people.

You now have all of the strategies you need to begin to tackle any knowledge barriers or general challenges you may have face as a woman in business, education, law, medicine, etc. You already have the will and the grit to move forward; you only need to take the first step. Know that I believe in you and that I am taking those steps with you. Sincerely, Mer Related articles

About Author: Meredith "Mer" CurryMer has always had a passion for education and helping historically underrepresented groups achieve access and success to higher opportunities. She has consulted nonprofits, educational institutions, and businesses in addition to her volunteerism and mentorship of students.

Learn more about Mer at www.meredithcurry.com. |

Photo from CityofStPete

RSS Feed

RSS Feed