ADVANCED ON PURPOSEAn educational blog with purposeful content. We welcome open and polite dialogue, and expect any comments you leave to be respectful. Thanks! Archives

May 2023

Categories

All

|

Back to Blog

5 MIN READ This article picks up after the 4th article in a series on "Financial Aid, College Choice, and COVID-19" In the last article in the series, Financial Aid, College Choice, and COVID-19, I spoke about the importance of supporting our students and families as they navigate the next steps in their college journeys by making sense of their financial aid options. In Supporting Students & Families through the Conundrum, I encourage college-bound students to “consider the power of savings and learn how to budget. You can make it work if you know what’s in front of you and take the time to thoughtfully plan it out.” This guidance should be given to students much earlier in this process, way before they apply to college. Comprehensive college access programs that work with first-generation and pell-eligible students often have a component in their curriculum that focuses on financial aid. Among the learning outcomes of such lessons, students will hear about budgeting and learn terms like “interest” and “credit” so that they can effectively manage their financial aid awards, like loans. In The Financial Aid Conundrum, I encourage us to take a step back and ask ourselves, “are our students truly equipped to tackle conversations and decisions around financial aid?” Because if the answer is no, then the next question should be, “what are we doing, or not doing, to help students understand basic financial concepts and empower them to make informed choices on their own?” As we learn from Treasury.gov, the financial literacy of our students in high school is lower than most countries. Furthermore, socio-economically disadvantaged students score lower in financial literacy, the equivalent of three school years.

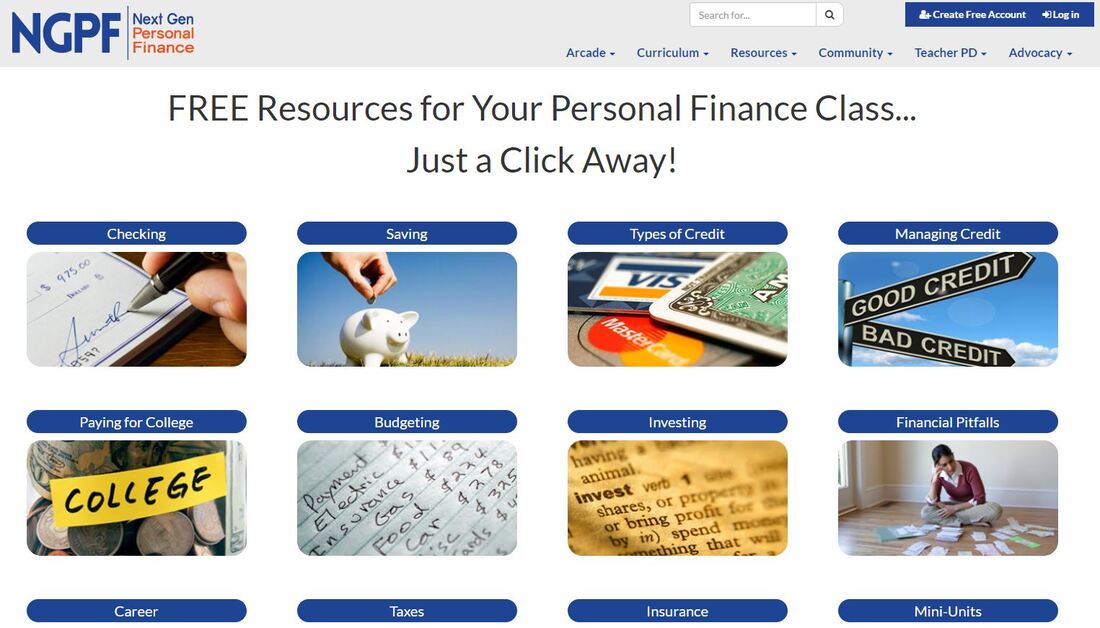

Here’s my attempt at making the relationships clearer: How early should students build their financial literacy to prepare for college? ASAP, early, and often! I agree with Next Gen Personal Finance (NGPF) who decided in 2014 that it was critical to provide teachers with access to “timely and relevant curricular resources, providing effective professional development, and advocating to increase access to financial education.” NGPF’s mission is to revolutionize the teaching of personal finance in all schools in order to improve the financial lives of the next generation of Americans. As of 2019, NGPF's curriculum and professional development extends to 25,000 middle and high school teachers reaching more than 2 million students. This grassroots movement of personal finance educators has committed to Mission: 2030. That is, by 2030, ALL students will take a one semester personal finance course before graduating from high school. Personally and professionally, I think we can and should do even more than one semester of a personal finance course during students’ secondary education. It should start as early as elementary school, have scaffolding throughout middle school, and be grounded in real-life decisions during high school. NGPF has a suite of curriculum broken into various units such as Types of Credit, Managing Credit, Paying for College, Budgeting, and Financial Pitfalls. Even when students are armed with the basic financial concepts they need to tackle financial aid, they will still need support. This is why I’ve worked with Moneythink since 2019 to support first-generation, pell-eligible students in navigating the financial aid process. Moneythink empowers students to invest in the future by building technology that clarifies college finances. In collaboration with the star-studded team at Moneythink, we hosted financial aid webinars in late April to support graduating high school seniors across the country. Check out the recording! Moneythink is gearing up to release their new public-facing tool, DecidED, this fall! DecidED completely removes the guesswork out of college affordability for students and their families, as well as enables counselors and advisors in the space to have productive conversations with their students about the tradeoffs of college options. DecidED helps students and their families:

Check out how Moneythink is working to support students and advisors through COVID-19 and beyond. Follow and subscribe to Moneythink's email list to stay up to date. “Together, we can help our students not just survive but thrive. Not just complete, but succeed. Our students can achieve #lessdebtmoredegrees while we design a pathway towards an economically sustainable future for themselves and their families.” Want to learn more about financial literacy and financial aid issues?

Here are a few resources to help you build your knowledge and comfort-level with discussing these issues with colleagues, students, and families.

2 Comments

Read More

Leave a Reply. |

Photo from CityofStPete

RSS Feed

RSS Feed