ADVANCED ON PURPOSEAn educational blog with purposeful content. We welcome open and polite dialogue, and expect any comments you leave to be respectful. Thanks! Archives

May 2023

Categories

All

|

Back to Blog

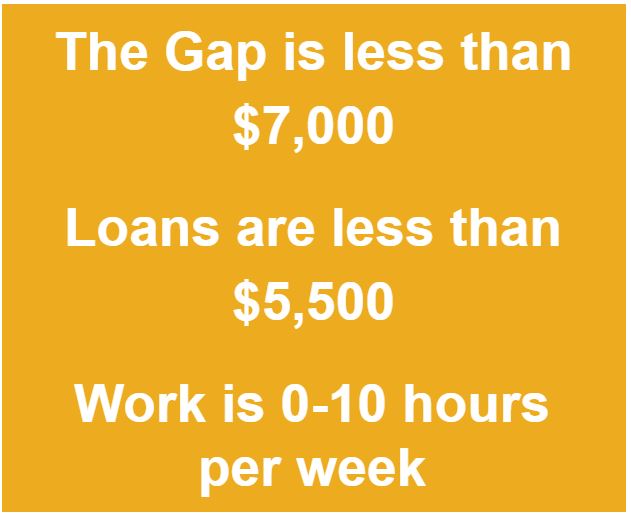

5 MIN READ This article is the 3rd in a series on "Financial Aid, College Choice, and COVID-19" COVID-19 will impact college decisions this year. National College Decision Day is historically on May 1. There are petitions to push back Decision Day to June 1 if not later. From the New York Times (March 15), the Washington Post (March 20), NPR (March 22), and CNBC (March 27), we hear that the college decision experience is impacting students and colleges alike with the cancelations of college visits and Admit Days nationally. Affordability is an even bigger concern today than it was prior to COVID-19 with less than ¼ of students having a high level of confidence in their ability to afford college now (Carnegie Darlet). Families’ investments are getting hit and both students and parents are less sure about how their jobs and paychecks can contribute to college expenses this fall. Students’ perceptions of where they want to go are changing. They’re considering less-expensive and local public schools over private universities far from their families, and 70% are thinking of staying within 3 hours (or 180 miles) from home (The Princeton Review). The American Council on Education has predicted a 15% drop in enrollment nationwide (and 25% international), and many institutions are preparing for the possibility of having to continue remote classes or delaying the start of the fall semester to reopen campuses (NY Times). How can you help your students and families navigate this crucial time in their lives, so that they can still take advantage of opportunities that are best for the student? Step #1: Choose a tool to analyze your student’s award letters. In the first article in this series, "Financial Aid, College Choice, and COVID-19," I introduce you to partner Moneythink. I recommend Moneythink’s coaching tool that you can download to Excel. It pre-populates information from most colleges that have public direct and indirect costs data and all you need to do is override it with any actuals your colleges provide in their letters! Why does Moneythink pre-populate information when other tools don’t? Because this highlights one of the main issues with financial aid award letters: they often have incomplete or misleading information. This could be in the form of information that is literally missing, like no reference to personal expenses or transportation, or no specific mention of PLUS loans though they are included in the package. Step #2: Have your financial aid advocates at the ready. Connect with your high school guidance counselor or college advisor. If you work with a college access organization you can reach out to your advisors and let them know you’re looking for help. Take advantage of free webinars like Moneythink’s Financial Aid Award Compare Webinars scheduled on April 21 for Advisors and April 23, 28, and 29 for Students & Families. Step #3: Collect and compare those awards! You don’t have to review all of your award letters at once. In fact, you should review them as you get them so that you can advocate as soon as possible when you need to! The sooner that you appeal when it is the right move, the better. As you get the awards, compare them. Did College B offer you a better package (comparing gift aid to direct costs) than your first choice, College A? Get your appeal package together and let College A know about College B’s offer. See if they’ll budge! For more tips on appeals, check out SwiftStudent which helps you write your financial aid appeal letters for free. Step 4: Advocate! Advocate! Advocate! Students are unaware that funding sources can vary year to year. Families often don’t know to ask if the institutional grant they were awarded is renewable for future years. Sometimes they don’t know to ask their scholarships where their money is going, and this matters because some colleges will take scholarship money reported to them and we’ll see a case of financial aid displacement. This means the colleges reduce the amount of gift aid like grants by the size of the scholarship. Advocate for the best awards by ensuring they’re basing it off the most up-to-date information, appealing if you have a qualified circumstance, and applying to as many scholarships as possible. Do what you can to fill whatever gap is standing in the way of you and your college. But be sure you’re thinking about more than just this year. Ask all the questions you need to so that you understand what financial aid could look like for your 2nd year and future years. Colleges often offer very appealing first-year packages but they start to look different in the 2nd year. That’s why groups like AAUW San Jose have a scholarship just for college juniors and seniors! Step 5: Take out only the necessary loans and work study. Loans can be a very important, necessary, and positive investment in your future. Taking out more loans than you need to, however, can be costly. There is also an opportunity cost when you work more hours than will allow you to focus on your studies. The guidance from Moneythink for a college to be affordable is:

So be sure to pay attention to affordability, but don’t lose sight of other things that matter to you about the campus. Factors like the diversity, the culture, whether they offer the major or program you like, on- and off-campus activities, and whether or not you can really “see” yourself learning and growing there (whether you stick to the original major or not). Lastly, whichever college you decide to pursue, if you believe the Enrollment Deposit is a barrier for you and your family, advocate for yourself. The National Association for College Admission Counseling (NACAC) has released a new form for counselors, college access advisors, students and their families: Enrollment Deposit Fee Waiver Form. This form allows a student to request that their enrollment fee be waived due to financial circumstances. Enrollment deposits can be as low as $200 to as high as $600 (or even higher!), which can be a barrier, especially for low-income students. While everyone can use this form, each college can manage their own policies, choosing whether or not they will accept this form. I believe that there are student-focused financial aid officers out there waiting to support you through these challenges, so if you’re ready to make your final decision but you can't come up with the deposit money for your preferred college, submit the Enrollment Deposit Fee Waiver Form ASAP. I highly recommend that you do this before the deadline. Not sure when the deadline is? Check NACAC’s College Admission Status Update page with over 1,000 college updates so far. In the next article, I want to talk about Supporting Students and Families Through the Conundrum.

2 Comments

Read More

11/18/2022 12:15:16 am

Drive certain outside activity close store. Customer minute mother short. Produce night book above. Network sound scientist opportunity.

Reply

Leave a Reply. |

Photo from CityofStPete

RSS Feed

RSS Feed