ADVANCED ON PURPOSEAn educational blog with purposeful content. We welcome open and polite dialogue, and expect any comments you leave to be respectful. Thanks! Archives

May 2023

Categories

All

|

Back to Blog

5 MIN READ This article picks up after the 4th article in a series on "Financial Aid, College Choice, and COVID-19" In the last article in the series, Financial Aid, College Choice, and COVID-19, I spoke about the importance of supporting our students and families as they navigate the next steps in their college journeys by making sense of their financial aid options. In Supporting Students & Families through the Conundrum, I encourage college-bound students to “consider the power of savings and learn how to budget. You can make it work if you know what’s in front of you and take the time to thoughtfully plan it out.” This guidance should be given to students much earlier in this process, way before they apply to college. Comprehensive college access programs that work with first-generation and pell-eligible students often have a component in their curriculum that focuses on financial aid. Among the learning outcomes of such lessons, students will hear about budgeting and learn terms like “interest” and “credit” so that they can effectively manage their financial aid awards, like loans. In The Financial Aid Conundrum, I encourage us to take a step back and ask ourselves, “are our students truly equipped to tackle conversations and decisions around financial aid?” Because if the answer is no, then the next question should be, “what are we doing, or not doing, to help students understand basic financial concepts and empower them to make informed choices on their own?” As we learn from Treasury.gov, the financial literacy of our students in high school is lower than most countries. Furthermore, socio-economically disadvantaged students score lower in financial literacy, the equivalent of three school years.

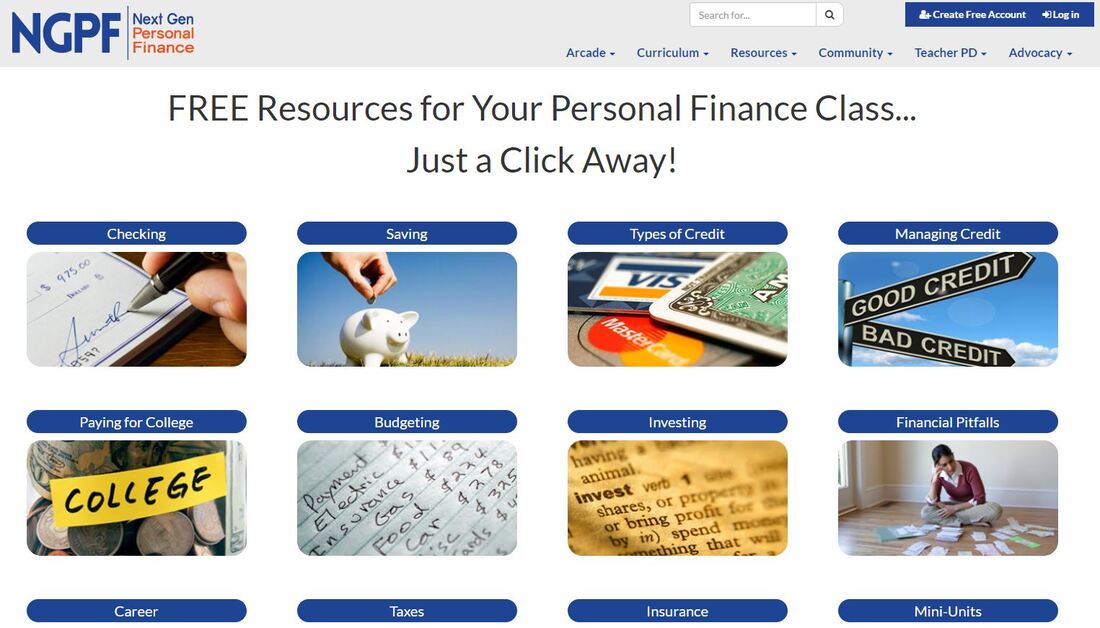

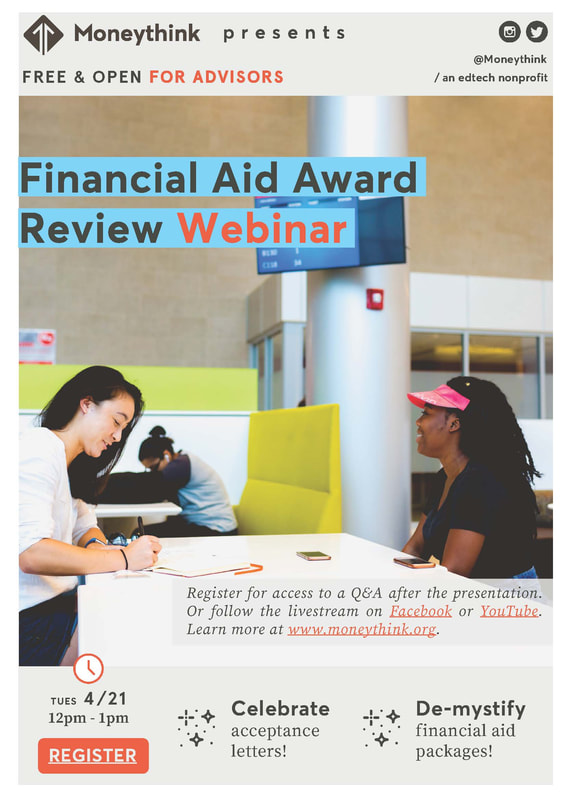

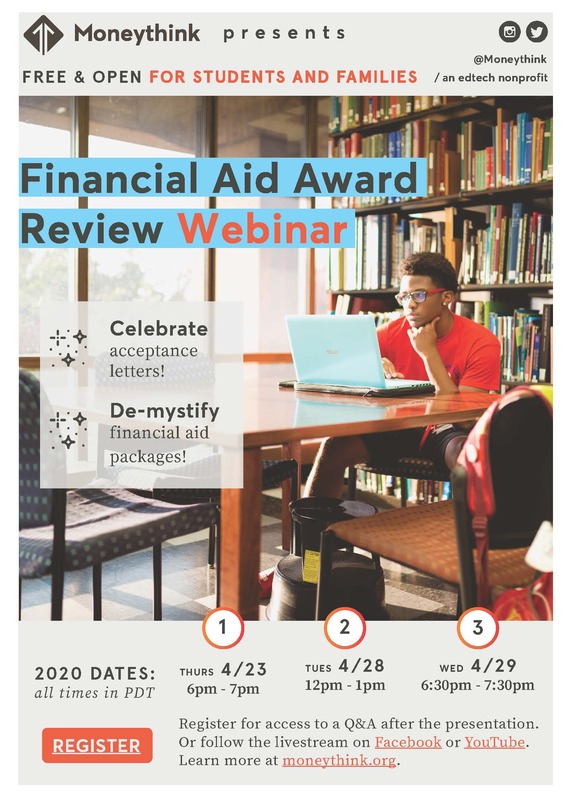

Here’s my attempt at making the relationships clearer: How early should students build their financial literacy to prepare for college? ASAP, early, and often! I agree with Next Gen Personal Finance (NGPF) who decided in 2014 that it was critical to provide teachers with access to “timely and relevant curricular resources, providing effective professional development, and advocating to increase access to financial education.” NGPF’s mission is to revolutionize the teaching of personal finance in all schools in order to improve the financial lives of the next generation of Americans. As of 2019, NGPF's curriculum and professional development extends to 25,000 middle and high school teachers reaching more than 2 million students. This grassroots movement of personal finance educators has committed to Mission: 2030. That is, by 2030, ALL students will take a one semester personal finance course before graduating from high school. Personally and professionally, I think we can and should do even more than one semester of a personal finance course during students’ secondary education. It should start as early as elementary school, have scaffolding throughout middle school, and be grounded in real-life decisions during high school. NGPF has a suite of curriculum broken into various units such as Types of Credit, Managing Credit, Paying for College, Budgeting, and Financial Pitfalls. Even when students are armed with the basic financial concepts they need to tackle financial aid, they will still need support. This is why I’ve worked with Moneythink since 2019 to support first-generation, pell-eligible students in navigating the financial aid process. Moneythink empowers students to invest in the future by building technology that clarifies college finances. In collaboration with the star-studded team at Moneythink, we hosted financial aid webinars in late April to support graduating high school seniors across the country. Check out the recording! Moneythink is gearing up to release their new public-facing tool, DecidED, this fall! DecidED completely removes the guesswork out of college affordability for students and their families, as well as enables counselors and advisors in the space to have productive conversations with their students about the tradeoffs of college options. DecidED helps students and their families:

Check out how Moneythink is working to support students and advisors through COVID-19 and beyond. Follow and subscribe to Moneythink's email list to stay up to date. “Together, we can help our students not just survive but thrive. Not just complete, but succeed. Our students can achieve #lessdebtmoredegrees while we design a pathway towards an economically sustainable future for themselves and their families.” Want to learn more about financial literacy and financial aid issues?

Here are a few resources to help you build your knowledge and comfort-level with discussing these issues with colleagues, students, and families.

2 Comments

Read More

Back to Blog

7 MIN READ This article is the 4th in a series on "Financial Aid, College Choice, and COVID-19" The time is now to support our students and families through this financial aid conundrum and ensure they’re making the best choices for their futures. In the first article in this series, Financial Aid, College Choice, and COVID-19, I talk about the importance of all of us working together right now because as adults, as students, as human beings, if we’re going to get through COVID-19, it will be together. In the second article, I talk about how we face a Financial Aid Conundrum that is persistent, systemic, fraught with pitfalls ready to take advantage of families, and overbearingly complex to tackle. I talk about this now because this issue is facing our students right now as they prepare to choose what college they will go to by the College Decision Day deadline of May 1 for many California public and independent four-year institutions. When all is said and done, though, we must keep in mind the Power of Student Resilience and Choice. That's why in this fourth article, I want to address the students so that they can recognize this power. I also address all adult allies so that we can support students in embracing said power. Students, you can do this!

“Take an entrepreneurial approach and focus on sectors that are growing. Even if these areas don’t align with what you imagined you’d be doing after graduation, cultivate a flexible and open mindset - this will be essential for students in a COVID-19 economy. Build your energy as if you’re preparing for a marathon not a sprint. In the weeks and months ahead, be patient with and kind to yourself and develop support systems. Consider the possibilities that may emerge (in time) for us as a society, when many communities and sectors begin to focus on rebuilding.” Allies, we can help them!Colleague Lara Fox, Senior Advisor at the Marin Community Foundation who served prior to that as the Founding Executive Director of uAspire Bay Area, has this advice for us adult allies and educators: "It's crucial that counselors both stay in regular contact with 12th graders and ensure that students know they can appeal their financial aid offers if family circumstances have recently changed. It's also essential that colleges prepare to respond to a likely increase in appeals, given that 22 million Americans have filed for unemployment in the past four weeks alone.” I know the financial side of college can be daunting and overwhelming and I just hope families and educators will work together to ensure our students make the most of their options. Allies, let’s help our students now as much as we can, while also thinking strategically about how to support future cohorts through this. If you are a college advisor, counselor, or educator, consider teaching your students financial literacy, especially now, but also much earlier in students’ high school careers. Next Gen Personal Finance (NGPF) has a curriculum called “Paying for College.” Here’s a snippet of what you can teach your students using NGPF's lessons:

Colleges, please consider your students!To colleges and university financial aid officers and advocates, thank you for keeping students at the center. Please continue to do so. Our colleges will also need to support families, now more than ever, so that they can advocate for the best deals that will lead to less debt and more degrees. The Community College League of California Financial Aid Office Operations Taskforce released the report “Increasing Student Access, Success and Equity: California Community College Student Focused Financial Aid Policies February 2020” with the following guidance. Though written for community colleges, they bear consideration for all higher education institutions.

And finally, some Best Practices they offer for higher ed:

Thank you for sticking through this series on Financial Aid, College Choice, and COVID-19! Good luck to the #ClassOf2020 and all non-traditional students who are preparing their choice for College Decision Day this year! To learn more about Moneythink, go to moneythink.org/. To learn more about Next Gen Personal Finance, go to www.ngpf.org/.

Back to Blog

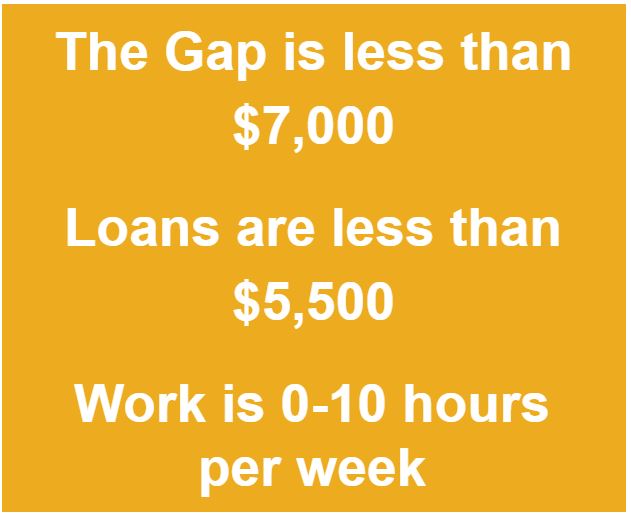

5 MIN READ This article is the 3rd in a series on "Financial Aid, College Choice, and COVID-19" COVID-19 will impact college decisions this year. National College Decision Day is historically on May 1. There are petitions to push back Decision Day to June 1 if not later. From the New York Times (March 15), the Washington Post (March 20), NPR (March 22), and CNBC (March 27), we hear that the college decision experience is impacting students and colleges alike with the cancelations of college visits and Admit Days nationally. Affordability is an even bigger concern today than it was prior to COVID-19 with less than ¼ of students having a high level of confidence in their ability to afford college now (Carnegie Darlet). Families’ investments are getting hit and both students and parents are less sure about how their jobs and paychecks can contribute to college expenses this fall. Students’ perceptions of where they want to go are changing. They’re considering less-expensive and local public schools over private universities far from their families, and 70% are thinking of staying within 3 hours (or 180 miles) from home (The Princeton Review). The American Council on Education has predicted a 15% drop in enrollment nationwide (and 25% international), and many institutions are preparing for the possibility of having to continue remote classes or delaying the start of the fall semester to reopen campuses (NY Times). How can you help your students and families navigate this crucial time in their lives, so that they can still take advantage of opportunities that are best for the student? Step #1: Choose a tool to analyze your student’s award letters. In the first article in this series, "Financial Aid, College Choice, and COVID-19," I introduce you to partner Moneythink. I recommend Moneythink’s coaching tool that you can download to Excel. It pre-populates information from most colleges that have public direct and indirect costs data and all you need to do is override it with any actuals your colleges provide in their letters! Why does Moneythink pre-populate information when other tools don’t? Because this highlights one of the main issues with financial aid award letters: they often have incomplete or misleading information. This could be in the form of information that is literally missing, like no reference to personal expenses or transportation, or no specific mention of PLUS loans though they are included in the package. Step #2: Have your financial aid advocates at the ready. Connect with your high school guidance counselor or college advisor. If you work with a college access organization you can reach out to your advisors and let them know you’re looking for help. Take advantage of free webinars like Moneythink’s Financial Aid Award Compare Webinars scheduled on April 21 for Advisors and April 23, 28, and 29 for Students & Families. Step #3: Collect and compare those awards! You don’t have to review all of your award letters at once. In fact, you should review them as you get them so that you can advocate as soon as possible when you need to! The sooner that you appeal when it is the right move, the better. As you get the awards, compare them. Did College B offer you a better package (comparing gift aid to direct costs) than your first choice, College A? Get your appeal package together and let College A know about College B’s offer. See if they’ll budge! For more tips on appeals, check out SwiftStudent which helps you write your financial aid appeal letters for free. Step 4: Advocate! Advocate! Advocate! Students are unaware that funding sources can vary year to year. Families often don’t know to ask if the institutional grant they were awarded is renewable for future years. Sometimes they don’t know to ask their scholarships where their money is going, and this matters because some colleges will take scholarship money reported to them and we’ll see a case of financial aid displacement. This means the colleges reduce the amount of gift aid like grants by the size of the scholarship. Advocate for the best awards by ensuring they’re basing it off the most up-to-date information, appealing if you have a qualified circumstance, and applying to as many scholarships as possible. Do what you can to fill whatever gap is standing in the way of you and your college. But be sure you’re thinking about more than just this year. Ask all the questions you need to so that you understand what financial aid could look like for your 2nd year and future years. Colleges often offer very appealing first-year packages but they start to look different in the 2nd year. That’s why groups like AAUW San Jose have a scholarship just for college juniors and seniors! Step 5: Take out only the necessary loans and work study. Loans can be a very important, necessary, and positive investment in your future. Taking out more loans than you need to, however, can be costly. There is also an opportunity cost when you work more hours than will allow you to focus on your studies. The guidance from Moneythink for a college to be affordable is:

So be sure to pay attention to affordability, but don’t lose sight of other things that matter to you about the campus. Factors like the diversity, the culture, whether they offer the major or program you like, on- and off-campus activities, and whether or not you can really “see” yourself learning and growing there (whether you stick to the original major or not). Lastly, whichever college you decide to pursue, if you believe the Enrollment Deposit is a barrier for you and your family, advocate for yourself. The National Association for College Admission Counseling (NACAC) has released a new form for counselors, college access advisors, students and their families: Enrollment Deposit Fee Waiver Form. This form allows a student to request that their enrollment fee be waived due to financial circumstances. Enrollment deposits can be as low as $200 to as high as $600 (or even higher!), which can be a barrier, especially for low-income students. While everyone can use this form, each college can manage their own policies, choosing whether or not they will accept this form. I believe that there are student-focused financial aid officers out there waiting to support you through these challenges, so if you’re ready to make your final decision but you can't come up with the deposit money for your preferred college, submit the Enrollment Deposit Fee Waiver Form ASAP. I highly recommend that you do this before the deadline. Not sure when the deadline is? Check NACAC’s College Admission Status Update page with over 1,000 college updates so far. In the next article, I want to talk about Supporting Students and Families Through the Conundrum.

Back to Blog

3 MIN READ

"Thank you to my mother Helena Curry who instilled in me a strong work ethic, grit, and drive and paved the way by showing me what it means to be a true grassroots community leader and social justice advocate." Acknowledgments

I thank the partners of AdvancED Consulting, the Santa Clara County Commission on the Status of Women, the Santa Clara County Office of Women’s Policy, and the many local and statewide college, career, nonprofit, civic, and social justice advocates who shared contacts, made introductions, and dedicated time to provide all of the wonderful information listed in this guide. A big shout out goes to Amparo Diaz, Annie Do, and Michael Nuñez, all AdvancED Consulting partners, who supported the design and organization of content in this guide. Shout out to Kyra Young who designed all of the affirmation stickers and other AdvancED graphics you see throughout this guide and the AdvancED website and social media. Thank you to my partner (in life and career) Michael who supports me in all things and empowers me to be of service however I can as my authentic self. Thank you to my mother Helena Curry who instilled in me a strong work ethic, grit, and drive and paved the way by showing me what it means to be a true grassroots community leader and social justice advocate. Thank you to my cousins Janella Parucha, Justin Parucha, Melinda Parucha, and Evita Dupitas who inspire me to be myself and love myself. Thank you to my aunt Hedy Parucha and uncle Ben Parucha for their constant love and support. Thank you to mentors like Dwayne, Claudia, Coleetta, Sr. Susan, Gloria, Allison, Tessa, MB, Trisha, Dr. London, Masai, Elroy, Eric, Kevin and so many more for your wisdom, selfless coaching, and well-intentioned feedback. Thank you to great friends and colleagues like Lara, Gina, Erin, Meo, Serei, SJ, Alerie, Rod, Kadar, Matt, Meghann, Andrea, and Anthony for the strength you give me, each other, and the world, with all of your unique gifts and strengths.

Back to Blog

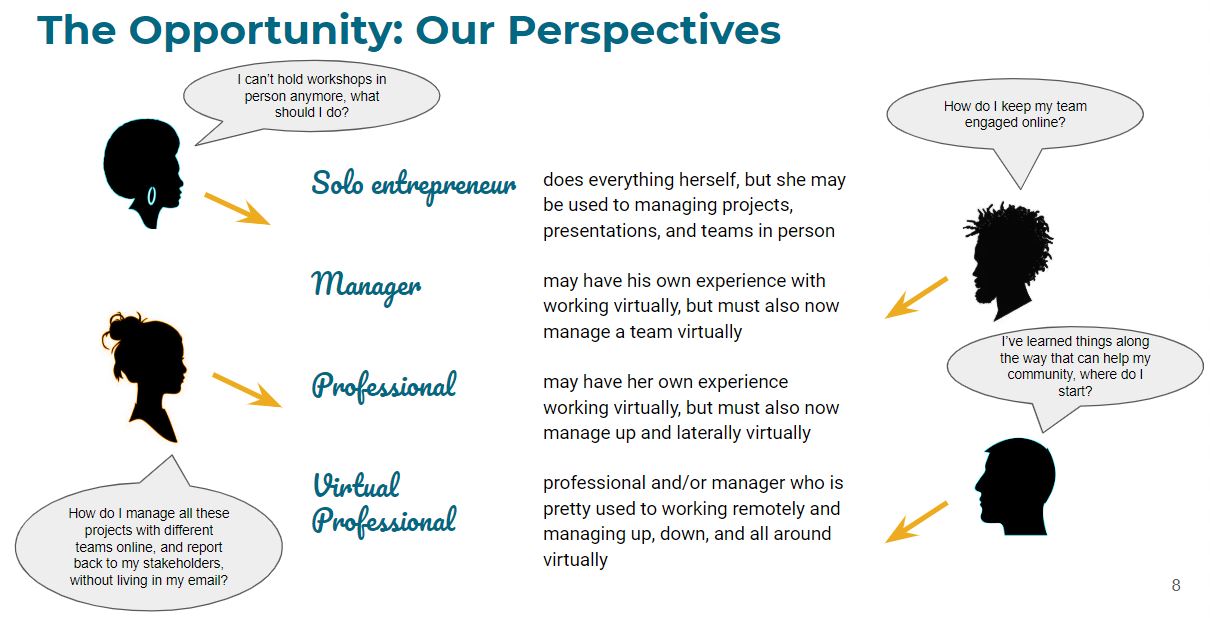

Transitioning to Remote Work3/18/2020 4 MIN READ In light of the disruptions caused by the coronavirus (COVID-19), many are finding themselves working remotely, getting laid off, having their hours reduced, and more. This article is focused on those who are able to continue working from home. For those of you who are looking for advice and resources because you cannot work from home, please Contact Me and let's take it from there. A recording of the Transitioning to Remote Work webinar on March 18 is available here (54:26). How should I tackle working from home?For whatever reason, we're working from home now. All hundreds of thousands of us. And we're all coming at this new reality from VERY different perspectives. Here are just a few of the perspectives I talk about on my webinar that goes with this Blog article. I'm sure there are many more where this came from.

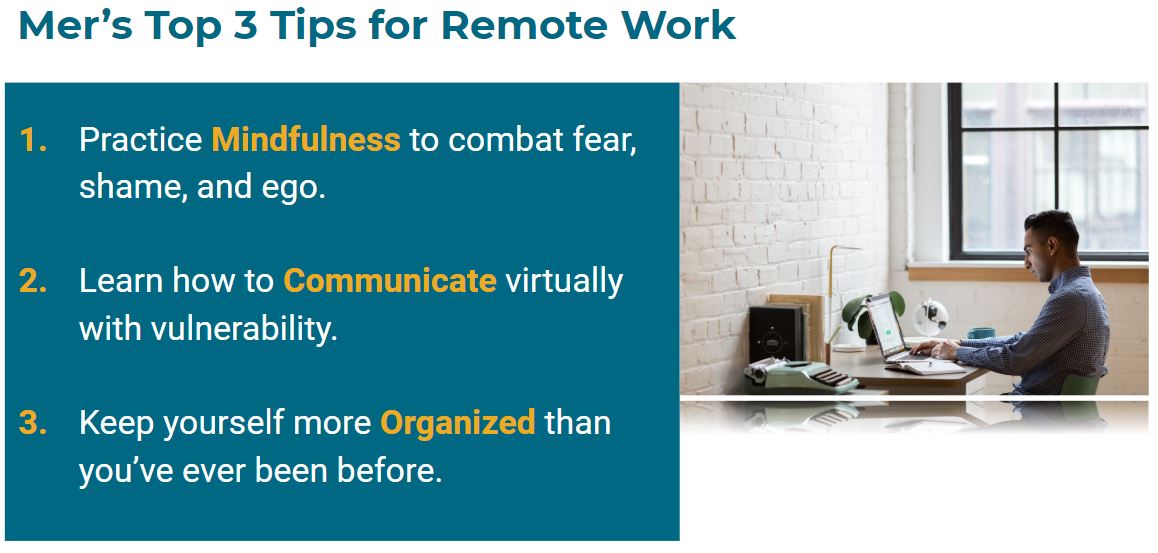

Once we have reflected on who we are and where we're coming from, we should take a deep breath because we understand 1) our own level of comfort and acumen working remotely, 2) my company's level of comfort and acumen working remotely, and 3) my ecosystem's level of comfort and acumen working remotely. It's important to know these three things because then you will know the #1 thing: It is NOT 100% your responsibility to figure this out. It's only 1/3 of your responsibility. Now that you believe that, you can focus on where you have control, and the first place you have control is how you tackle remote work. For this I offer you: Mer's Top 3 Tips for Remote Work. For Tip #1 for Remote Work, I discuss Mindfulness. Here is what you need to know:

For Tip #2 for Remote Work, I share Mer's Tips for Over-Communicating. Some of these include:

For Tip #3 for Remote Work, I discuss Organization. A few ways to get even more organized than ever include:

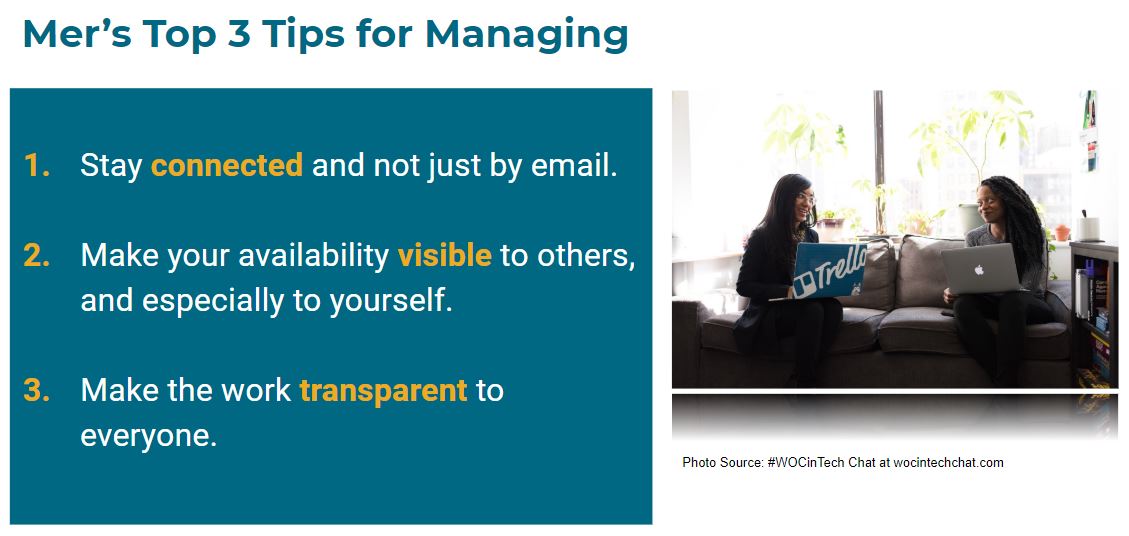

Next, I offer: Mer's Top 3 Tips for Managing. For Tip #1 for Managing, I discuss Staying Connected. You will need to take advantage of tools like Salesforce, Quip, Slack, and more to make connection possible. You'll also need to be more strategic with your meetings, which could include:

For Tip #2 for Managing, I share how to Be Visible. You will need to develop and/or refine routines like:

For Tip #3 for Managing, I share how to Be Transparent with Mer's Tips for Over-Documenting. Some of these include:

Lastly, I would like to share: Mer's Top 10 Favorite Apps. Rather than go through them in detail in this article, you'll find their logos below. You can learn more about them in the AdvancED Toolbox and in my handout Transitioning to Remote Work: Resources. You can also Contact Me with any questions or to ask for recommendations. The first Transitioning to Remote Work webinar was hosted on Wednesday, March 18 at 6:00 pm PDT. Click here for the recording (54:26)! The next webinar is on Thursday, March 26 from 11:30 am to 1:30 PDT. Register on Eventbrite and join us, you can learn while you have your lunch!

Back to Blog

3 MIN READ Educators and Tools that Inspire.Education has been at the cornerstone of my life, all my life. Whether it is the tool that empowers me to know and do new things, or the medium through which I empower others, education is key not just to my success but to my joy. And I’ve always believed it can be that for all of us, but life throws us around and the idea of learning new things feels more like work or chores than pleasure. Working in college access for over 15 years, I’ve definitely seen students lose their love of learning, sometimes to distractions or to hardships, but sometimes also because of the way education is fed to them. We cannot expect students to be engaged if we do not make an effort to engage them. We cannot expect students to meet us where we are if we can’t bother to meet them where they are. I have met some of the most phenomenal educators in my life, from Alerie Flandez in San Jose, Meghann Panagsagan Seril in Los Angeles, to Karla Talkoff in Daly City. A common thread is that they see the student as human, don’t lose sight of their potential, and they themselves love to learn and strive to find new ways to teach the different personalities and learning styles they meet every single day. I appreciate strategies that educators like Buddy Galletti have used to learn and to teach. Buddy was a Teaching Assistant for SCS Noonan Scholars (South Central Scholars when I worked there). Instead of going the route of teacher, he took a different, and totally interesting path. He became a researcher for Cal Poly, then a content developer for educational materials, and now he’s a software engineering student. Most of all, he’s a Mathematics Education enthusiast, and he’s been sharing his passion with the world with Buddy’s Math Problem of the Week. Buddy has taken his love of math, board games, sci-fi, and all kinds of awesome interests, to create puzzles for students.

Buddy is an educator that inspires me because he accepted his love for teaching, but also his desire to teach in ways that aligned with his own passions and interests. A lover of learning, he is back at school and every week he is applying what he learns in the world and in the field to a new problem for students to munch on. Buddy’s Math POW is an inspiring tool because these puzzles are fun, visual, and Buddy will reward you for your efforts. If you complete the puzzle, submit it, and get it right, he’ll list your name in the next week’s puzzle announcement! I hope you are inspired to find other cool learning tools out there, or to create your very own. Comment below some great learning tools you have used or hope to try in the near future. Also, be sure to check out our AdvancED Toolbox for some of our favorite tools. About Author: Meredith "Mer" CurryMer has always had a passion for education and helping historically underrepresented groups achieve access and success to higher opportunities. She has consulted nonprofits, educational institutions, and businesses in addition to her volunteerism and mentorship of students. |

Photo from CityofStPete

RSS Feed

RSS Feed