ADVANCED ON PURPOSEAn educational blog with purposeful content. We welcome open and polite dialogue, and expect any comments you leave to be respectful. Thanks! Archives

May 2023

Categories

All

|

Back to Blog

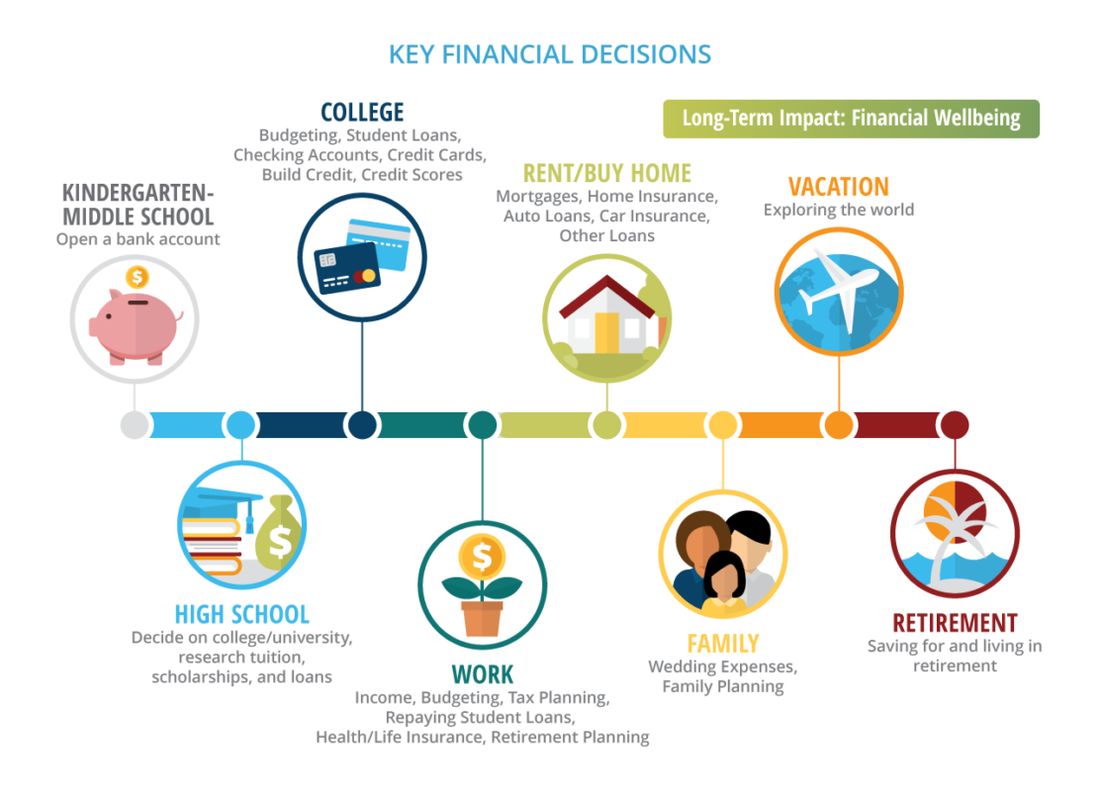

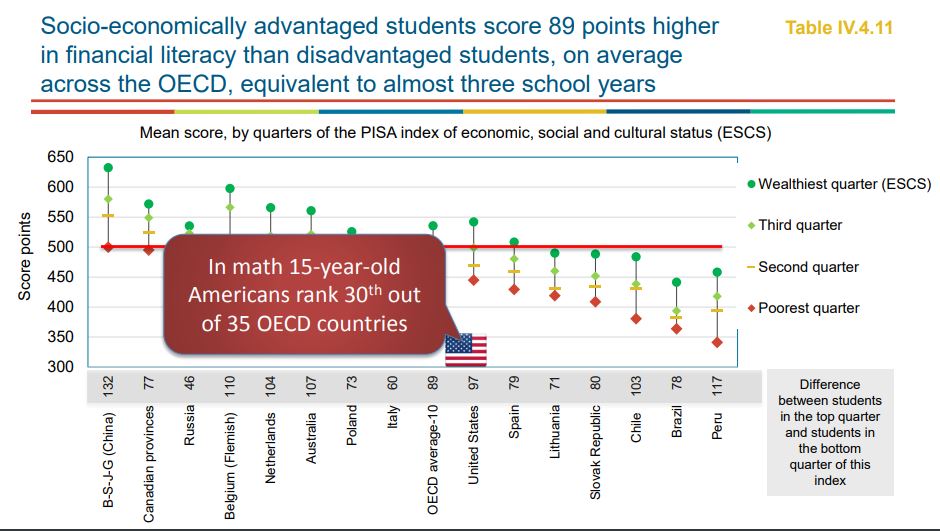

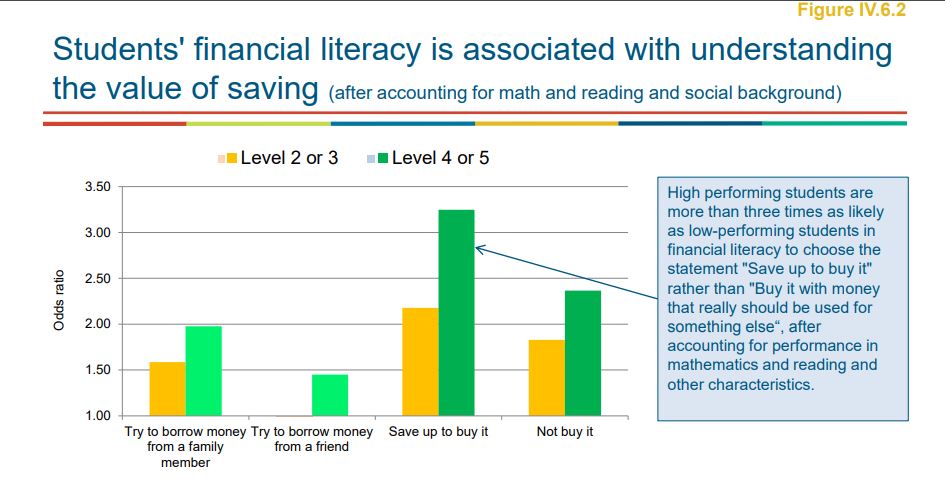

The Financial Aid Conundrum4/15/2020 13 MIN READ This article is the 2nd (and longest!) in a series on "Financial Aid, College Choice, and COVID-19" There are a lot of key financial decisions that we need to make as humans in this country. As you’ll see from the image below, they really start in high school with college-related decisions. When I think of this time in our high school seniors’ (and non-traditional students’) lives and put myself in their shoes, the two questions that come up for me are: 1. Am I going to college this Fall or Spring, and 2. If I am going to college, where? There is actually a third question, since there is a financial component to both questions. That question is 3. Depending on where I go to college, how much will I have to pay to go there? and this question is what I refer to as the Financial Aid Conundrum. It’s a conundrum because, firstly, I really enjoy that word and have few opportunities to use it. Secondly, because the synonyms for conundrum are in line with what students, families and educators face when it comes to financial aid, synonyms like “enigma,” “mystery,” “brain-teaser,” and “problem.” In the first article in this series, "Financial Aid, College Choice, and COVID-19," I talk about the power of networking and how I learned about Next Gen Personal Finance (NGPF) and their podcast "Tim Talks To..." In one podcast, what Melissa shares with Tim Ranzetta gets at the heart of what college-bound high school seniors are struggling with RIGHT NOW, and with 3.7M high school seniors expected to graduate from high school this 2019-20 school year according to the National Center for Education Statistics, it will require a huge, coordinated, all-hands-on-deck approach. Let’s all work together, utilizing all the expertise and tools in our toolbelts to support all these seniors through not just high school graduation, but also through important decisions that will impact their futures. Because many of these decisions are FINANCIAL. Here is the financial conundrum broken down into three (3) issues. Grab a seat and get comfy. Issue #1 This issue affects all students, but disproportionately for low-income students of color. Moneythink has done a ton of research on this issue, and there’s plenty of great information out there speaking to the issues of college persistence and student debt. Here are three facts we want you to know:

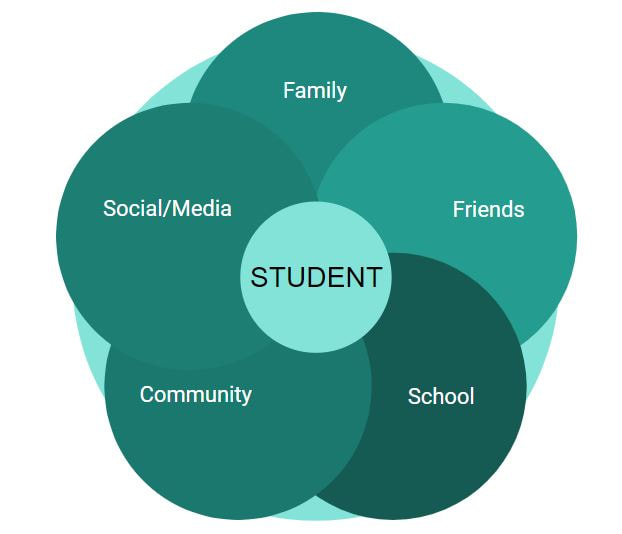

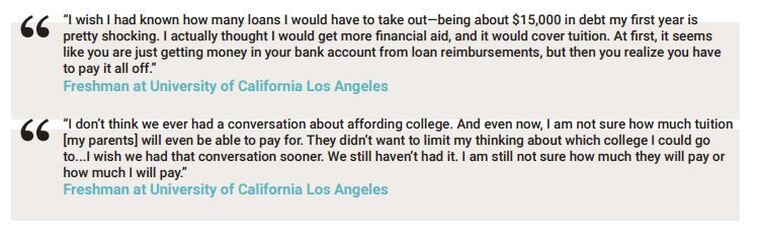

What does this all mean? That despite our best efforts to get students to college, especially first-generation students, they are ending up with too much debt and the lack of clarity about financial aid is largely to blame. Debt is a huge persisting problem since so few colleges are considered affordable to students struggling the most to pay, and to make things worse, students end up with debt whether they get their certificate or degree or not. If students are choosing (though, we argue, without a clear understanding) to go to unaffordable colleges, they are more likely to drop out because of financial reasons. If they knew they were doing this, would they willingly take out thousands of dollars in loans without the promise of an actual degree to make it worth their investment? Most of us education advocates, advisors, and counselors would argue of course not. So the question is, how do we get students to be more informed and empowered owners of their college choices? Let’s first look at how students understand this choice, and who helps them to understand.

In Moneythink’s College Success Report which they published in 2016, student interviews revealed two driving factors of students’ financial vulnerability:

Students are also not having open and honest conversations with their parents about how they will be paying for college, and not because they don’t want to, sometimes because they just don’t know how to. While as allies and advisors, we might want to be in these conversations with each and every student to guide and support them, it’s just not possible given our bandwidth. I recommend resources like Moneythink and CaliforniaColleges.edu that offer talking points for students on how to talk to their families about money. Tools to bring clarity to families Even if a student has open and honest dialogue with their families about money, the process of reviewing and analyzing financial aid awards is still very convoluted, and unnecessarily so. The financial aid award is the only document that will tell families how much college will cost. Unfortunately, despite the availability of an aid template provided by the Department of Education to both simplify and clarify financial aid, colleges have their discretion to use whatever manner of jargon and incomplete information makes sense for their cultures, which leads to misleading information that often prevents families from using them effectively to make informed, intentional decisions. According to a report by New America & uAspire:

The Department of Education offers comparison tips on its website, and the National Association of Student Financial Aid Administrators (NASFAA) offers a worksheet, which students and families can print out, to help keep information about different colleges organized. Community capacity The research shows us that our community doesn’t have the capacity to provide quality college advising and counseling when it comes to financial aid, even with the best intentions at play:

Despite the best efforts of our colleagues in the field, financial aid is incredibly confusing, it changes on the regular, information from the powers that be don’t regularly or clearly trickle down to the people on the ground that need to disseminate the information to students, and training is not readily available to solve for the lack in knowledge and experience. The Powers That Be The Federal Student Aid office has recommended that colleges include the cost of attendance in aid letters and clearly distinguish between grants and scholarships, which don’t need to be repaid, and loans, which do. (Federal Student Aid) The Powers That Be, or the colleges that are designing and distributing their financial aid award letters, are recognizing the problem but are operating on their own timelines and priorities to solve this issue for students. Now that we’ve fully discussed why the Financial Aid Conundrum is such an issue not just for all students, but especially for low-income, first gen students, let’s look at the remaining issues because yes, there are still more. Issue #2 College decisions don’t focus enough on the financial considerations and implications. College decisions are about both WHERE a student is going to spend the next 1-6 years of their next academic and career journey, and HOW MUCH they are going to pay over time as an investment in their future. The process of evaluating financial aid awards requires multiple complex steps. Every single one of these steps requires a level of maturity and mathematical savvy, and for the right information to be in students’ hands all at once. In Moneythink’s interviews spanning thousands of students, many students shared that they were left unassisted and confused during the process. In many cases, students were not adequately prepared for college. In some cases, students received the help that they needed to be accepted into the school of their choice, thanks to the support of well-intentioned family, engaged college counselors, and available college access programs. Unfortunately, they were often expected to figure out the rest once they got to college, especially when it came to the finances.

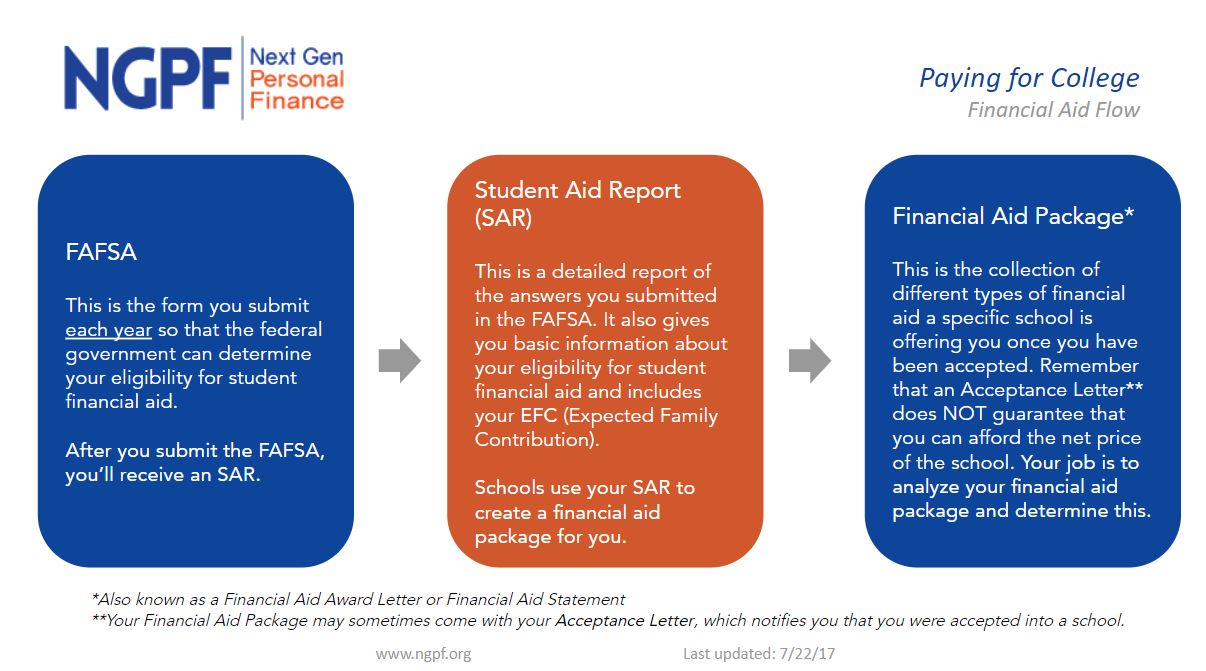

Organizations like ScholarMatch, Students Rising Above, Richmond Promise, the Early Academic Outreach Program (EAOP), Destination College Advising Corps, and more, serve students during the crucial transactional steps of their senior year and will walk students step-by-step through the financial aid application process. Once students complete their FAFSA, they will receive a Student Aid Report (SAR) and that will offer an Expected Family Contribution (EFC). A student EFC of zero (0) is the lowest possible value, and it means that the family has no ability to contribute to the student’s education. The highest EFC is $99,999. After a student submits their FAFSA, they may be asked for more information. This is called Verification. The SAR will note if the student has been selected for verification, or the college may contact the student directly. “Verification is the process your school uses to confirm that the data reported on your FAFSA form is accurate. If you’re selected for verification, your school will request additional documentation that supports the information you reported.” (Federal Student Aid) Once you’ve made it through verification, you should have a final award letter, as opposed to an award estimate. You will need to review this award letter so that you understand:

Earlier I shared that there are tools out there to help figure out the financial aid award review process. The problem, however, isn’t the lack of tools to help clarify and make sense of award letters. There are tools out there like the FinAid Letter Comparison Tool (with an advanced version available), BigFuture’s award tool, or CaliforniaColleges.edu’s use of the CollegeOPTIONS’ Financial Aid Award Comparison Tool. The real problem is that, while tools exist to compare financial aid awards for multiple colleges, these tools often require:

There is no tool out there that supports students and families in better understanding their financial aid award letters that does not also require them to manually enter that information into some document. This is fraught with user error and is a barrier to entry in multiple ways (lack of technical skills, variance in how award letters name and describe aid, incomplete awards, etc.). This is why I’m excited for Moneythink’s award compare tool coming out in October 2020 that will let you take snapshots of your awards for a super-fast analysis! Want to learn more about it? Click here to get on Moneythink’s listserve! Issue #3: Students often don’t realize just how much power they have in their college choice.

Despite all this challenge and calamity, there is still hope! Students DO have the power of their choice. Students DO have the time and opportunity to look at all the information available and make an informed, intentional decision about where they’re going to go this Fall or Spring. Students CAN and SHOULD resolve to make choices in their best interest that help meet goals they have designed for themselves. And as the parents, advisors, counselors, educators, coaches, guardians, and adult allies in their lives, we CAN and SHOULD resolve to support them however we can to make the best, most affordable decision possible. In this next article, I want to talk about how students can do this. It’s time to talk about The Power of Student Resilience and Choice because you DO have choices as a student. Students: The power to choose IS ALL YOURS.

3 Comments

Read More

8/28/2020 03:18:52 pm

Thank you for outlining all of the challenges that exist around college access. There's a lot of great info here, and I'll be sure referring back not only for my children but to advise others.

Reply

1/25/2024 02:48:45 am

Great insights on financial aid planning! This article provides valuable tips and strategies for navigating the complexities of funding education. A must-read for anyone seeking financial support for their academic journey!

Reply

Leave a Reply. |

Photo from CityofStPete

RSS Feed

RSS Feed