COVID-19 Financial News

Here at AdvancED we believe whole-heartedly in the complete person. We also know that finances impact every human being, whether you're an employee, entrepreneur, or a manager.

We're tracking the financial implications of the coronavirus. Check this page for updates and news as you forecast and set short- and long-term goals during this crisis.

We're tracking the financial implications of the coronavirus. Check this page for updates and news as you forecast and set short- and long-term goals during this crisis.

FAQs: Higher Education Emergency Relief Fund and Emergency Financial Aid Grants under the Cares Act

From the Internal Revenue Service (IRS)

The IRS announced that the grants provided to students under the CARES Act for food, housing and other COVID-19 expenses will not be counted as taxable income. Review the FAQs which includes questions such as:

From the Internal Revenue Service (IRS)

The IRS announced that the grants provided to students under the CARES Act for food, housing and other COVID-19 expenses will not be counted as taxable income. Review the FAQs which includes questions such as:

- Q1: I am a student who received an emergency financial aid grant under section 3504, 18004, or 18008 of the CARES Act for unexpected expenses, unmet financial need, or expenses related to the disruption of campus operations on account of the COVID-19 pandemic. Is this grant includible in my gross income?

- Q2: I received an emergency financial aid grant under the CARES Act and used some of it to pay for course materials that are now required for online learning because my college or university campus is closed. Can I claim a tuition and fees deduction for the cost of these materials, or treat the cost of these materials as a qualifying education expense for purposes of claiming the American Opportunity Credit or the Lifetime Learning Credit?

|

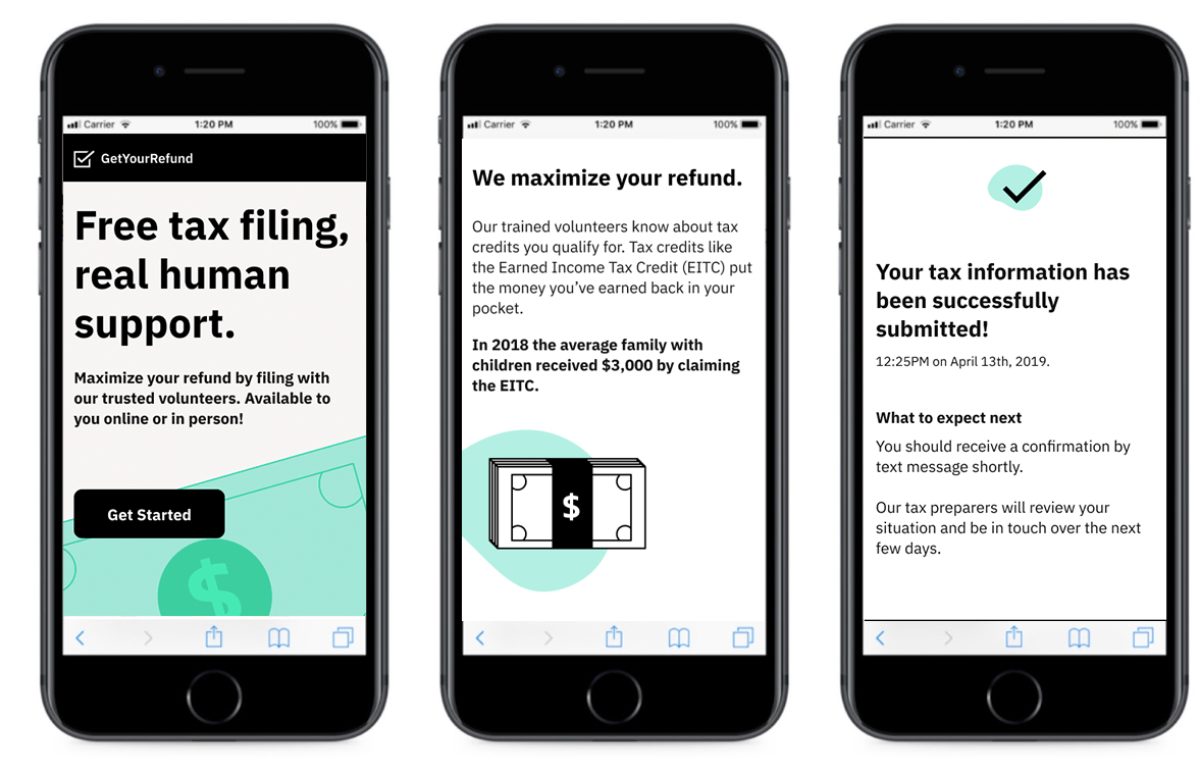

Free tax filing, real human support

From Code for America At GetYourRefund.org you can maximize your refund by filing with our trusted volunteers. We can file your taxes for tax years 2016, 2017, 2018, and 2019. Our trained volunteers know about tax credits you qualify for. Tax credits like the Earned Income Tax Credit (EITC) put the money you’ve earned back in your pocket. GetYourRefund.org is a non-profit service built by Code for America in partnership with IRS-certified Volunteer Income Tax Assistance (VITA) sites nationally. |

COVID 19 Business Resources

From the Silicon Valley Organization

The Silicon Valley Organization (SVO) has created COVID 19 Business Resources to support local small businesses through current challenges.

Banks offering help to customers impacted by the coronavirus

From Bankrate

Banks across the country are taking steps to help consumers impacted by the deadly coronavirus. Here’s a running list of decisions some banks have made to support customers with CDs, checking accounts and other types of savings products who are struggling to make ends meet.

AdvancED Consulting, LLC